Located at the intersection between Asia, Europe and Africa, the Middle East’s data centre market has grown considerably over the past few years. This has notably been driven by growing volumes of business and consumer data, increasing cloud adoption, the emergence of 5G networks and government initiatives to build smart, connected cities.

Limited deregulation of the telecom and digital infrastructure sectors has historically favoured state-owned enterprises in many Middle Eastern countries. Looking forward, it is expected that clearer data sovereignty laws and new legislation to open up the region to foreign entities will continue to have a positive impact on the data centre market.

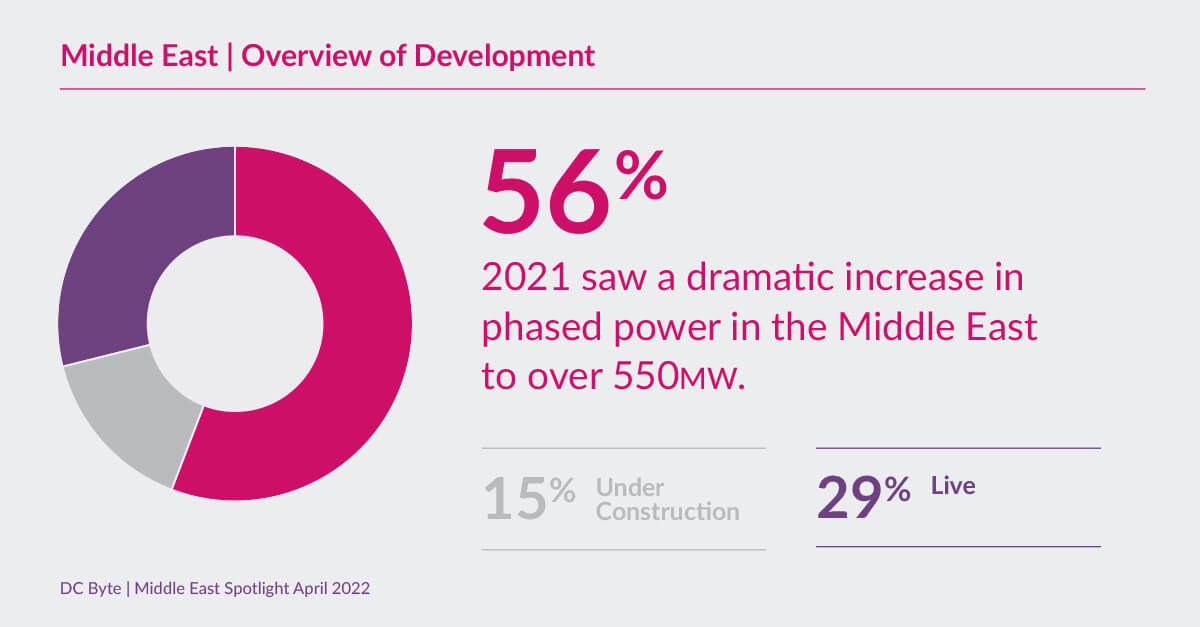

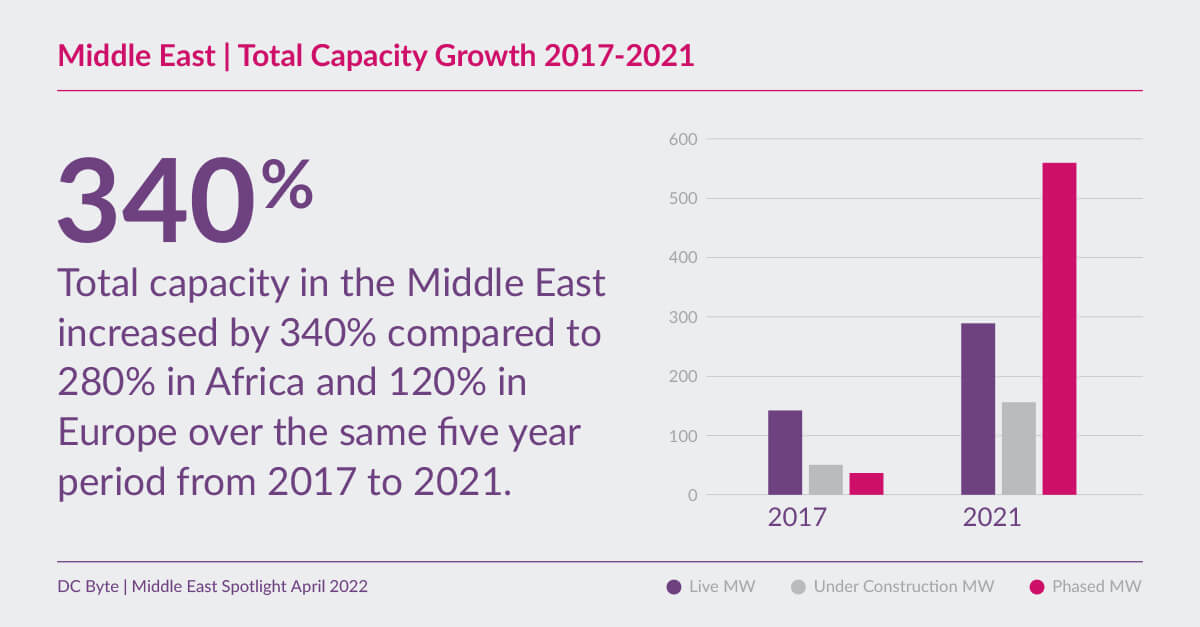

Total capacity in the Middle East increased by 340% from 2017 to 2021, compared to 280% in Africa and 120% in Europe over the same five year period. 2021 saw a dramatic increase in phased (planned) power in the Middle East to over 550MW, now accounting for 56% of total capacity, compared to 29% live and 15% under construction. This illustrates the market’s potential and suggests that demand is projected to remain high over the coming years.

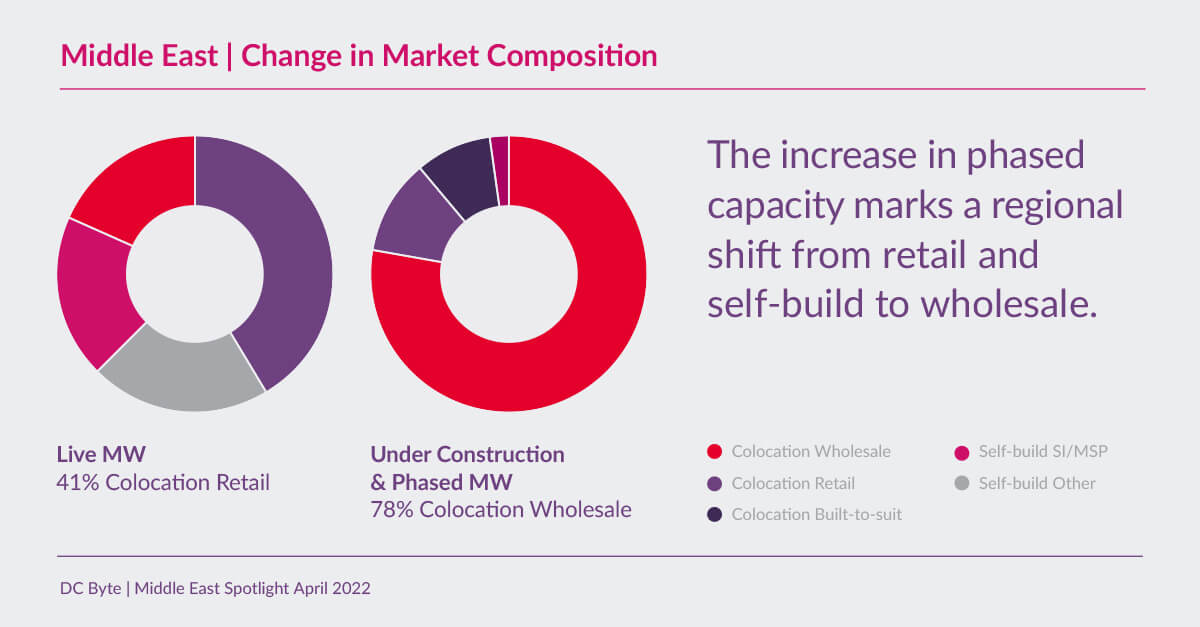

The increase in phased capacity also marks a regional shift from retail and self-build facilities to larger, wholesale colocation projects. As the market develops and governments adopt digital-first strategies, many new developments will be aiming to attract hyperscale clients and accommodate the Middle East’s increasingly digitalised economies centred around smart cities, AI and 5G technologies.

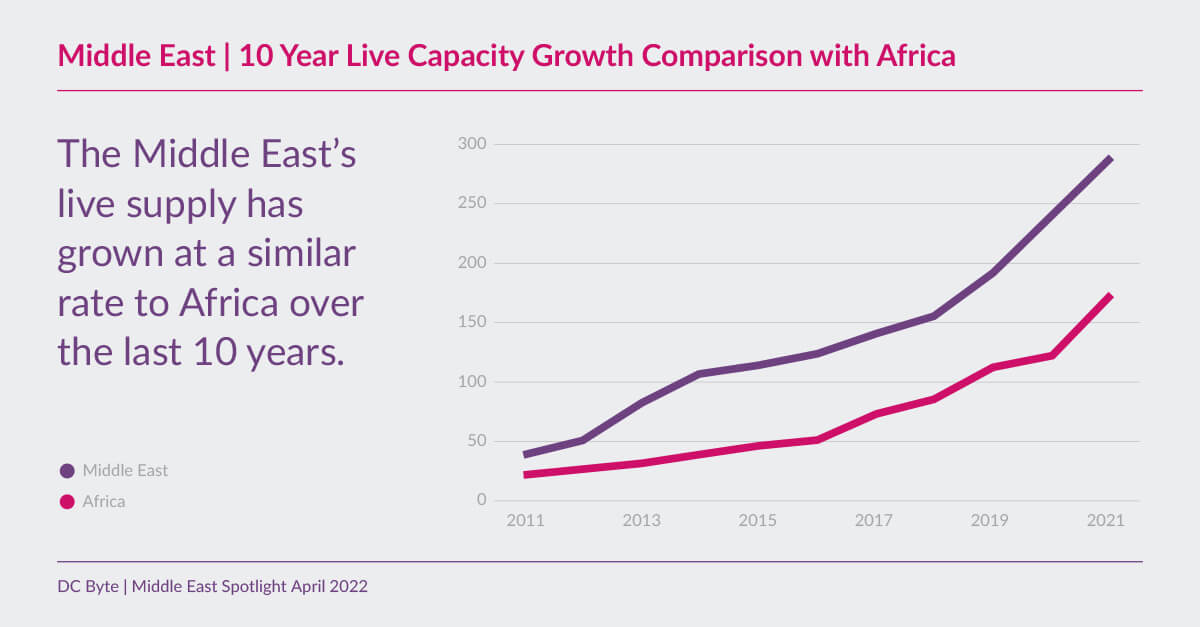

To put the region’s growth into perspective, it is interesting to note that the Middle East’s live supply has grown at a comparable rate to Africa over the last decade. Africa is one of the world’s fastest-growing emerging markets, with live supply increasing at a CAGR of 23% over the last ten years, driven by an expanding colocation market, improving digital infrastructure and rising foreign interest. Despite its larger data centre market, the Middle East’s live supply has similarly grown at a CAGR of 22% in the same time period. The Middle East market is also more developed despite its relatively small population of c.250 million, compared to Africa’s 1.3bn.

The Middle East’s growth in recent years has underlined its position as a major emerging market. Governments are adapting, cloud regions are expected in all the key markets and larger wholesale facilities represent 78% of under construction and phased capacity. With a significant portion of phased power, the region continues to have high growth potential and we can expect data centres to play an increasingly important role in the Middle East’s new digital age.