In APAC Tokyo leads, driven by announcements from Princeton Digital Group, Lendlease and Vantage

DC Byte, the leading data centre research and analytics platform, has today shared latest statistics and insights from its most recent ‘Data Centre Report’, published in partnership with Knight Frank, the leading global property adviser.

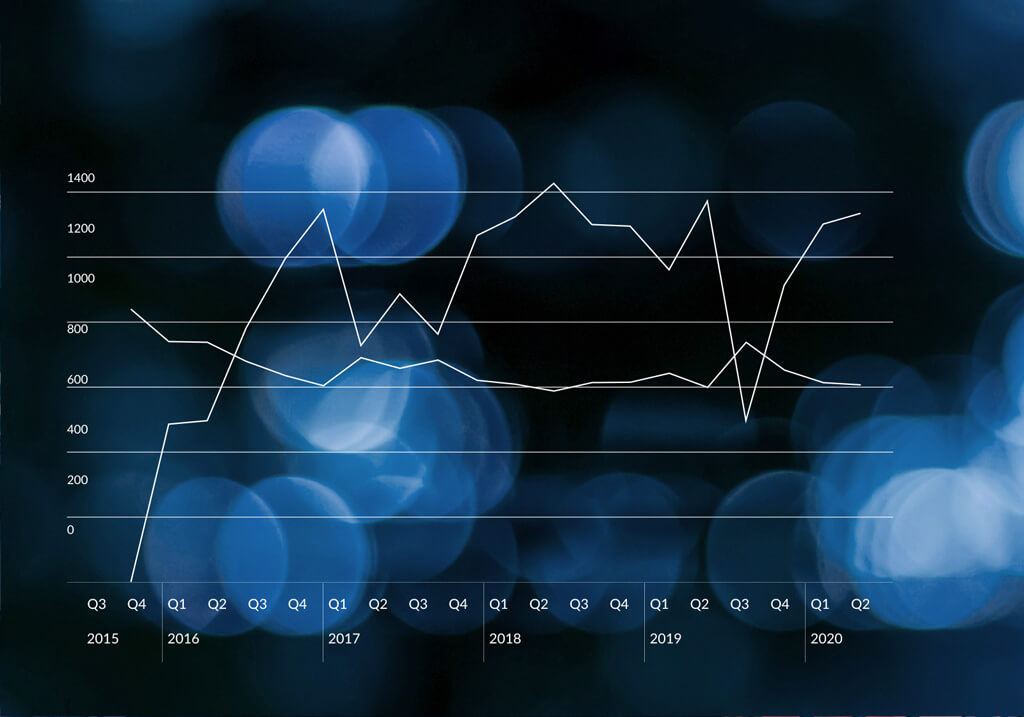

Whilst 2021 initially brought uncertainty as to what demand would look like after the increased buying cycles accelerated by the global pandemic, supply growth in fact continued to be strong across EMEA. The market now shows signs of settling on continued core expansion and moderate expansion in new markets outside of Frankfurt, London, Amsterdam, Paris and Dublin. Hyperscalers drive continued cloud demand across both markets.

Of the leading markets, development has been most notable in Dublin and London, with Q2 growth of 146MW and 122MW respectively. For Dublin, this is a significant expansion almost matching the total for 2020, and higher than the Q1 expansion at just over 100MW.

London’s growth in Q2 2021 matched the pace of Q2 2020 growth. London’s take-up in the same timeframe was 25MW, demonstrating the strength of a colo-dominated market alongside the agility of progressing planned development. US public cloud operators are also now assessing potential self-build cloud infrastructure expansions in London as demand for cloud services grows; whilst Google’s purchase of land in Broxbourne, and AWS acquiring a site in Didcot, marks a significant shift in market dynamics.

Added to the EMEA market profiles in Q2 is Nigeria which continues to undergo rapid expansion. Africa Data Centres is entering the Lagos market, whilst MainOne is building its second data centre in the city. Cloud Exchange West Africa is building its first data centre in Nigeria, in partnership with Huawei.

Ed Galvin, Founder and CEO at DC Byte, said: “We expect the trend toward expansion across EMEA, outside of FLAPD, to continue. On the hyperscale horizon, 2021 will see facilities in seven markets come online as Belgium, Denmark, Finland, Spain, and Sweden all add capacity, in addition to the core markets of Amsterdam, which is rapidly evolving into both a colocation and enterprise hyperscale location, and Dublin. This is a record for a single year. Istanbul and Warsaw are other ‘edge’ markets to keep an eye on.”

Looking to the APAC territories also covered by ‘The Data Centre Report’, take-up across the region in the second quarter was again around 95MW, on par with the quarterly average recorded in 2020 and the 75MW in Q1. Supply increases remain healthy, growing by over 700MW in Q2.

Specifically, Tokyo led the supply increase with nearly 250 MW, driven by announcements from Princeton Digital Group, Lendlease and Vantage, whilst Shanghai added just over 200 MW. Shanghai’s Q2 growth brings the 2021 increase to about 75 percent of the growth seen in 2020, with increasing interest from hyperscalers in this market. Seoul added 90MW of supply which increases supply overall by 23 percent. Mumbai’s growth is still strong with 24MW added in Q2.

Stephen Beard, Partner and Co-Head of Global Data Centres at Knight Frank, said: “The data centre landscape continues to evolve rapidly as operators compete to secure land, develop new sites and increase market coverage. Investor interest is rising as a result, buoyed by escalating market activity and the predicted future growth trajectory of the sector. Data centres can realise higher returns than traditional real estate classes and as such, are firmly an asset class that is now attracting wider investor recognition.”

To view the latest Data Centre Report 2021 report please click here

“Of the leading markets, development has been most notable in both Dublin and London with Q2 growth of 146MW and 125MW respectively. Contributing to the supply in this territory was Amazon, CyrusOne and EdgeConneX.”