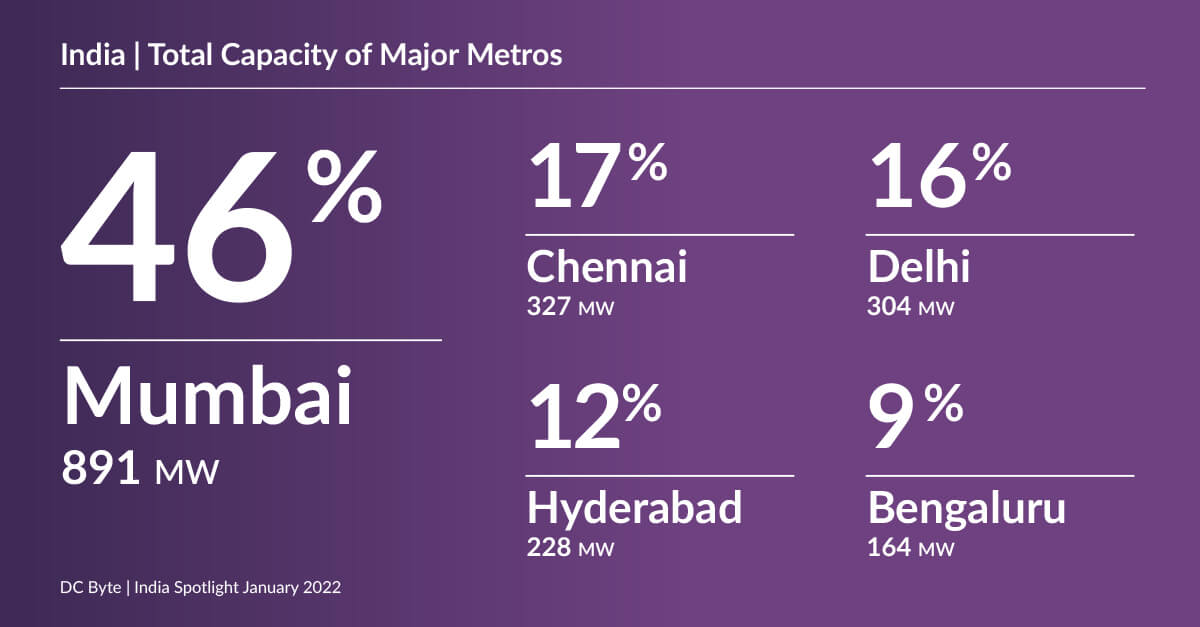

India’s data centre industry is primarily concentrated in five key metros: Mumbai, Delhi, Chennai, Hyderabad and Bengaluru. However, as more of the hyperscalers enter the region, the locations which they select will no doubt change the face of the market and fledgling metros such as Pune whose proximity to Mumbai means that it is seeing a great deal of interest, particularly from hyperscalers; and Kolkata will come into their own.

Key Metros

Mumbai

Currently the largest of Indian metros, Mumbai has attracted the majority of data centre activity to date and, in terms of total capacity, the market is larger than Chennai, Delhi and Hyderabad combined. All the capacity in Mumbai is spilt between two submarkets – Central Mumbai and Navi Mumbai. Currently, live capacity for Central Mumbai is 96MW and Navi Mumbai is 87MW. However, the under-construction development for Central Mumbai is 49MW compared to 198MW in Navi Mumbai. The main attraction towards the latter can be largely attributed to the area’s connectivity and the presence of several industrial hubs. However, due to the recent rise in demand there has been a substantial increase in land prices which may affect this trend.

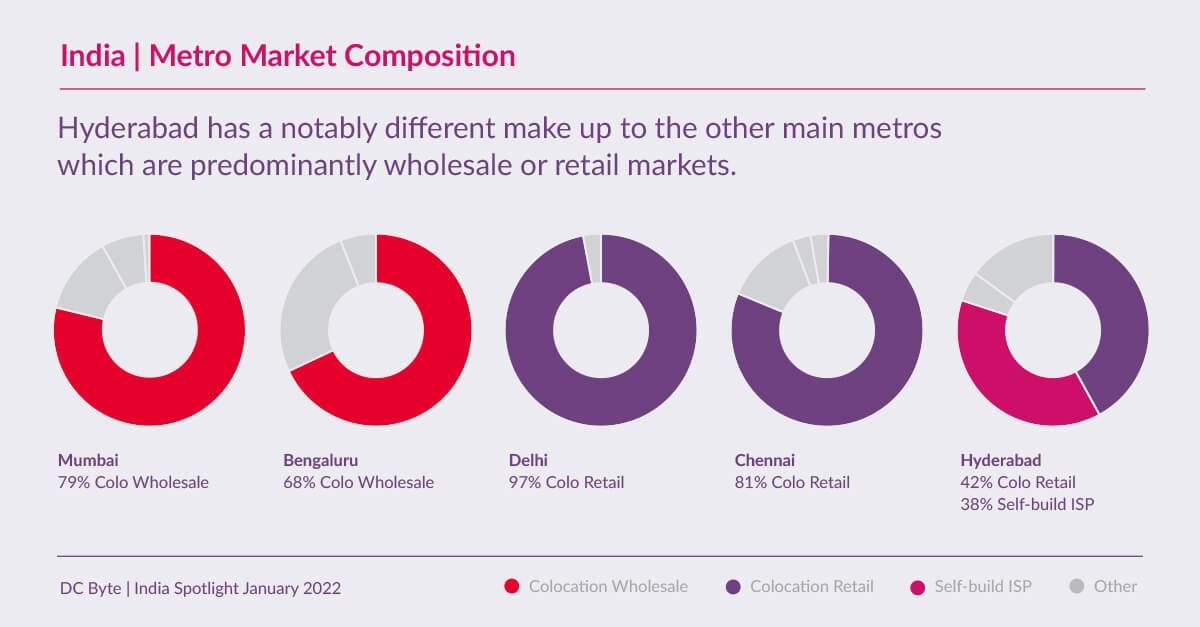

Mumbai’s market composition is similar to London in that it is wholesale dominated. International players have entered the market through joint ventures including EdgeConnex with Adani group forming AdaniConnex and Iron Mountain with Web Werks. We now expect these joint ventures to deliver sites and supply to increase over the coming years.

Mumbai saw the earliest growth in the Indian data centre market because of its access to a number of subsea cables, the availability of land and a strong push from the government.

Chennai

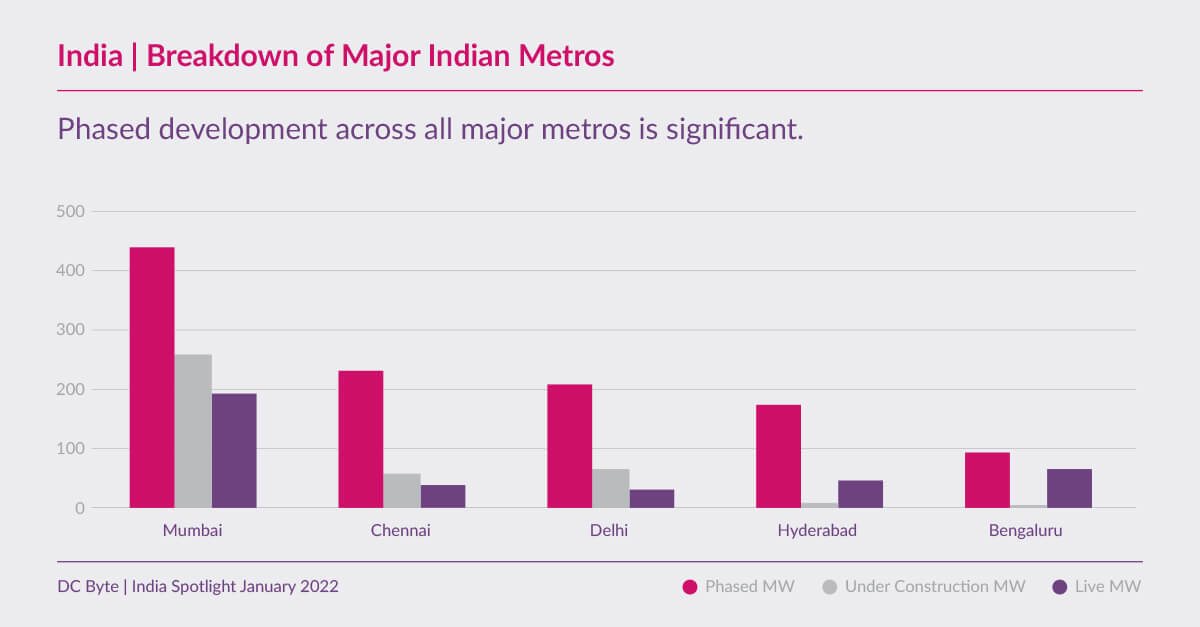

The Chennai market originally began as a disaster recovery location for facilities located in Mumbai. The area is quickly becoming a data centre hub for the east of India and with 232MW of phased capacity, we expect to see significant development in the Siruseri and Ambattur areas in the coming years. In the last eighteen months, Chennai has seen substantial investment with 241MW added to the aggregate supply. One of the reasons behind Chennai’s emergence as a key hub in India is due to the city having five submarine cables, with a further two due to go live in 2023.

Hyderabad

At present, Hyderabad is a relatively evenly balanced market with retail colocation and managed services accounting for 42% and 38% respectively. The city is strategically located in central India and has recently attracted interest from Amazon and Microsoft. Both hyperscalers have purchased sites to the south of the city and if others follow suit creating additional cloud regions in the area, it could become one of the largest submarkets in India.

Delhi

A primarily retail colocation dominated market, Delhi does not yet have any wholesale facilities live. Over the last 10 years, the Delhi market has performed similarly to Chennai in terms of live IT load capacities. As of Q3 2021, Delhi is ranked in 5th position amongst the key Indian metros in terms of live capacity; however, taking both under construction and phased power into account, we expect Delhi to become the 3rd largest metro in India. Most of the development in Delhi is in the Noida area.

Bengaluru

After Mumbai, Bengaluru has the second largest live IT capacity of the metro markets. The city is spilt into two main submarkets Whitefield and Electronic City. The market attracted investment early on with aggregate supply increasing by 32% in 2013. Bengaluru now only accounts for 8% of the total capacity in India. With the hyperscalers choosing Hyderabad as a new cloud region and Chennai seeing the development of two more submarine cables, we don’t expect to see much activity in the area in the short to medium term.