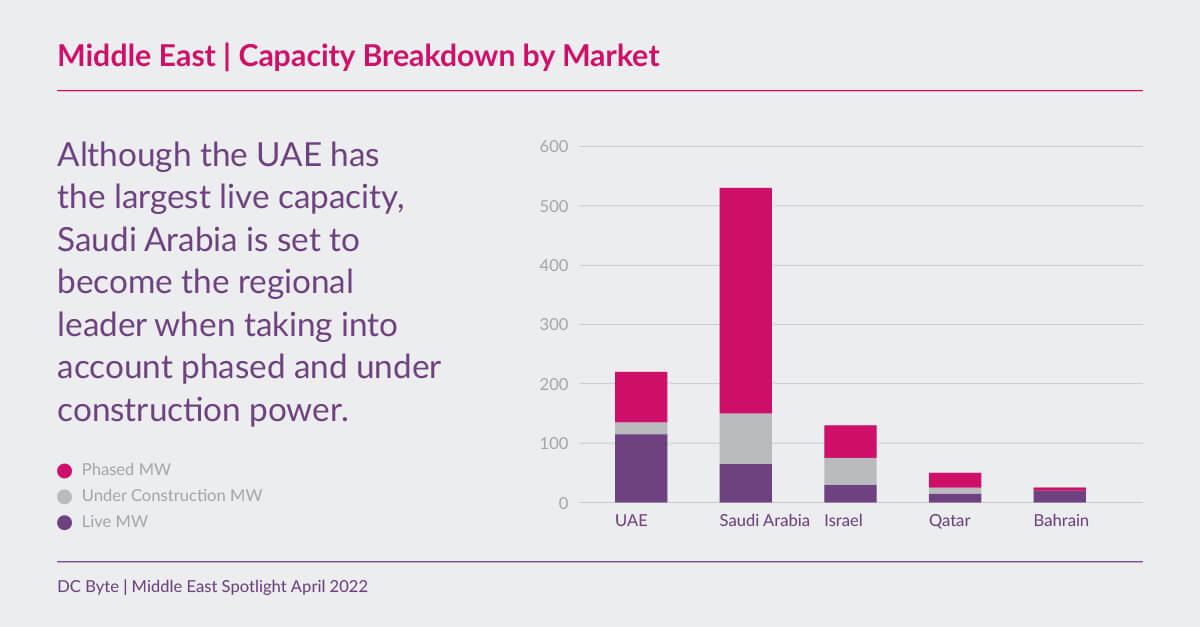

Located at the intersection between Asia, Europe and Africa, the Middle East’s data centre market has grown considerably over the past few years. The largest markets in the region are the UAE, Saudi Arabia and Israel, followed by Qatar, Bahrain and Oman. The metros that have attracted the most interest include Dubai, Abu Dhabi, Riyadh, Tel Aviv and Doha.

UAE

With the largest live capacity in the Middle East, the UAE market is primarily focused on Dubai and Abu Dhabi. The country has been supported by a boom in construction and expansion of its tourist economy and is currently a regional leader in the data centre industry with 114MW live capacity.

The UAE’s economic growth has been reflected in its data centre market – on average, the country’s live supply has increased by 10MW annually since 2011 and now has a total capacity of 222MW, which has tripled in the last five years.

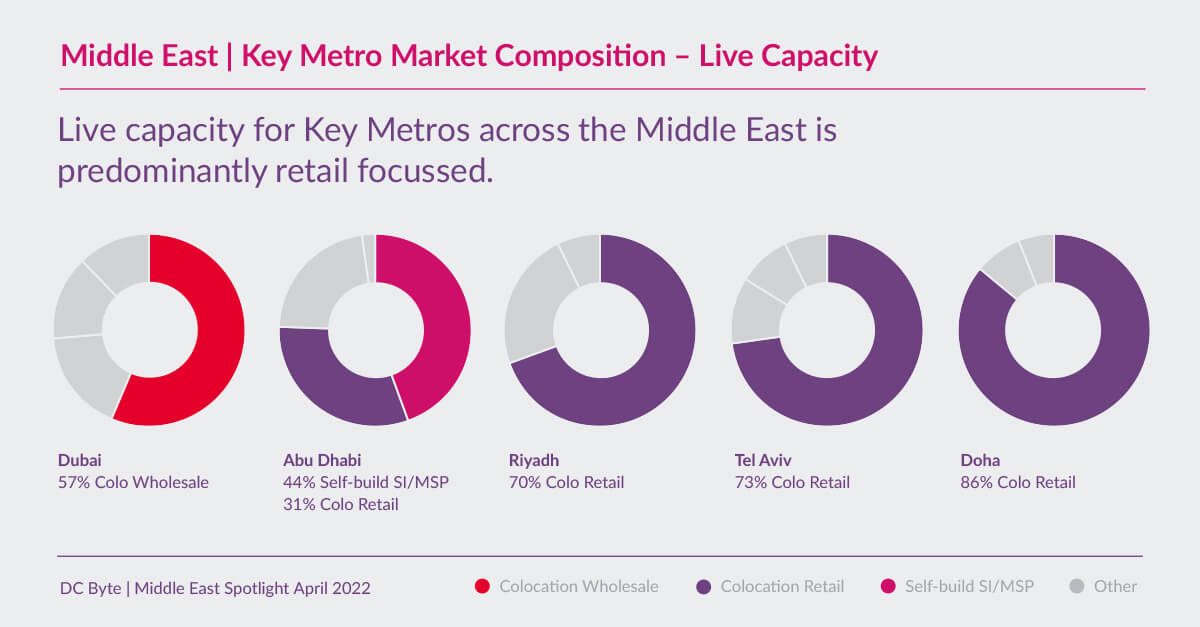

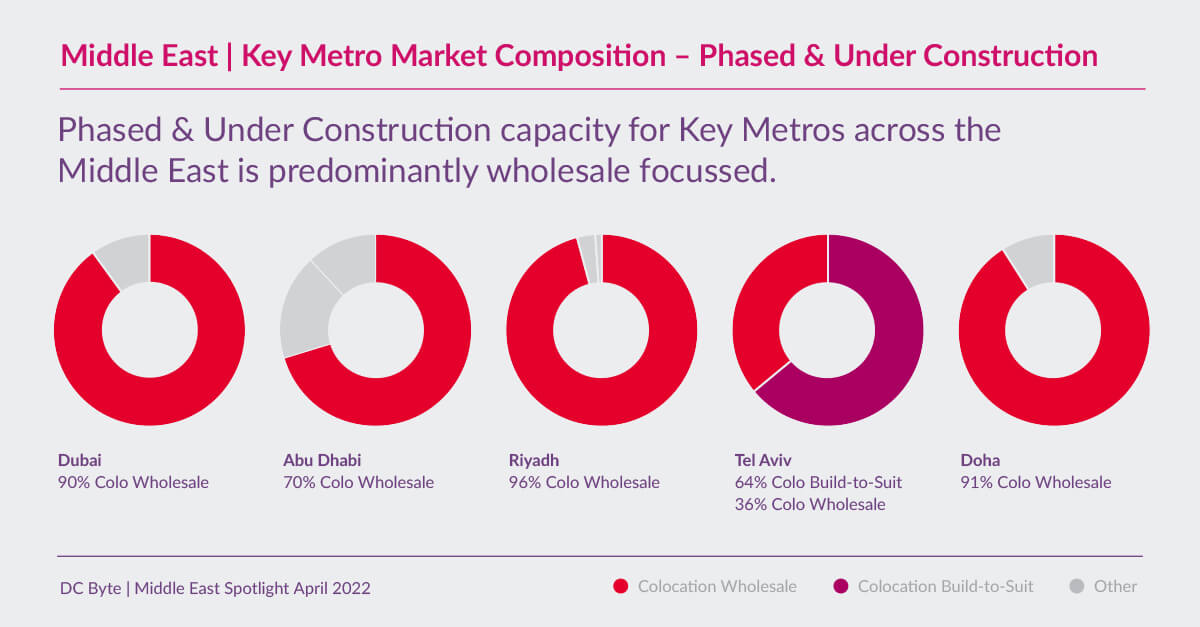

Looking forward, we expect growth to be increasingly wholesale-driven, representing 78% of phased and under construction capacity. Since December 2020, new legislation allows for a foreign entity to own 100% of a business in the UAE, although the impact of this on the data centre market has yet to be fully realised.

Saudi Arabia

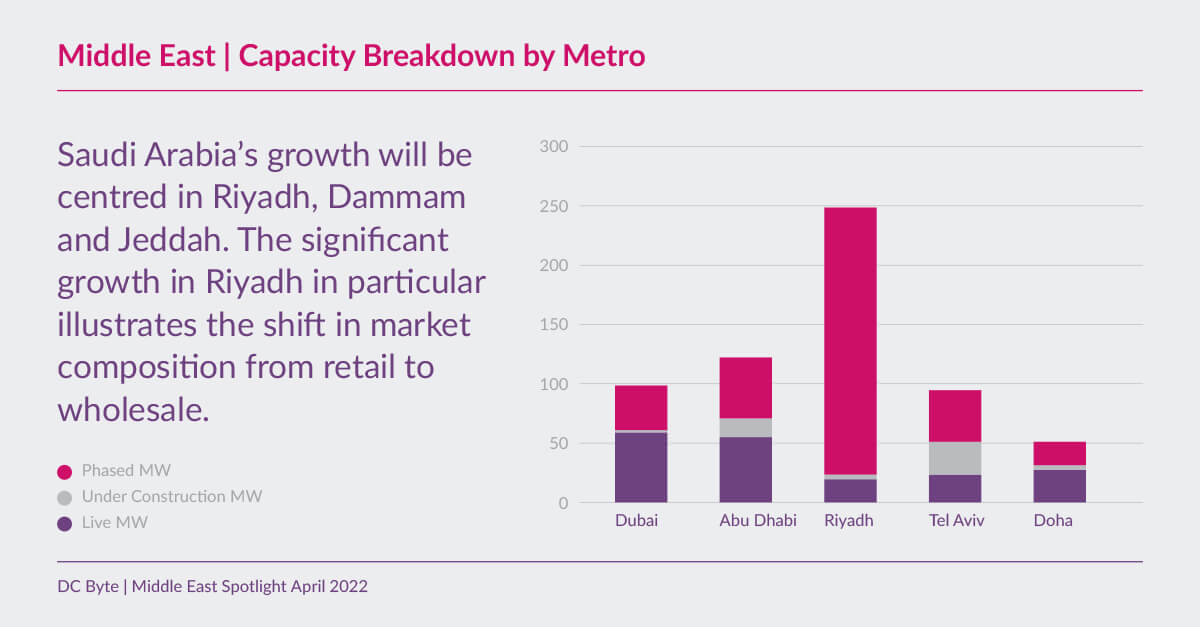

Despite the UAE’s current dominance, Saudi Arabia is set to become the regional leader when taking into account phased (planned) and under construction power, with total capacity reaching 529MW. To put this into context, Saudi Arabia currently accounts for 68% of the Middle East’s phased power. With live power currently at 67MW, this will translate to an almost 700% increase in capacity over the next few years as these projects materialise.

This significant increase in total capacity is predominantly led by wholesale facilities to accommodate the country’s ambitious goals and the region’s growing demand for data. The growth in Riyadh in particular illustrates the overall shift in the market with the composition forecast to become 88% wholesale colocation as opposed to being nearly 70% retail colocation today.

Israel

The third-largest in the Middle East with a total capacity of 130MW, Israel’s data centre market is largely based around Tel Aviv. Similarly to the UAE, the country’s total capacity has almost tripled in size since 2017.

The government’s Nimbus Project, which saw AWS and Google awarded contracts to provide cloud services to domestic government agencies, will have a strong impact on the country’s data centre landscape and is expected to bring at least an additional 70MW to the market – live power currently stands at 32MW. Although there is no live built-to-suit capacity, it now accounts for 64% of phased and under construction power in the Tel Aviv area, with wholesale taking up the remaining 34%.

Qatar

Doha is the key data centre market in Qatar – the city and its surrounding area account for the vast majority of the country’s supply. As the fourth-largest market in the region with 51MW total capacity, it is emerging as a popular cloud hub in the Middle East. Total capacity has increased at a CAGR of 45% a year from 2011-21, including a 54% rise in 2021.

Originally led by state-affiliated companies, the market has begun to see larger developments from foreign entities. Aggregate total supply increased by 54% in 2021, and with 56% of capacity phased or under construction, we can expect the market to continue its strong growth. Retail colocation currently accounts for 86% of the market, but as with other countries in the region, phased and under construction projects will translate to a sharp increase in wholesale capacity.

Bahrain

Excluding public cloud operators, which account for over 50% of total capacity, Bahrain’s data centre landscape is currently composed of various small retail-colocation providers and national telecoms facilities.

With 20MW of live capacity, Bahrain remains a small market relative to its neighbours such as Saudi Arabia and the UAE, but is anticipated to become an increasingly attractive destination for data centres. To put Bahrain’s potential into perspective, when the UAE had a similar capacity in 2013 its live supply subsequently increased by 150% over the following five years.

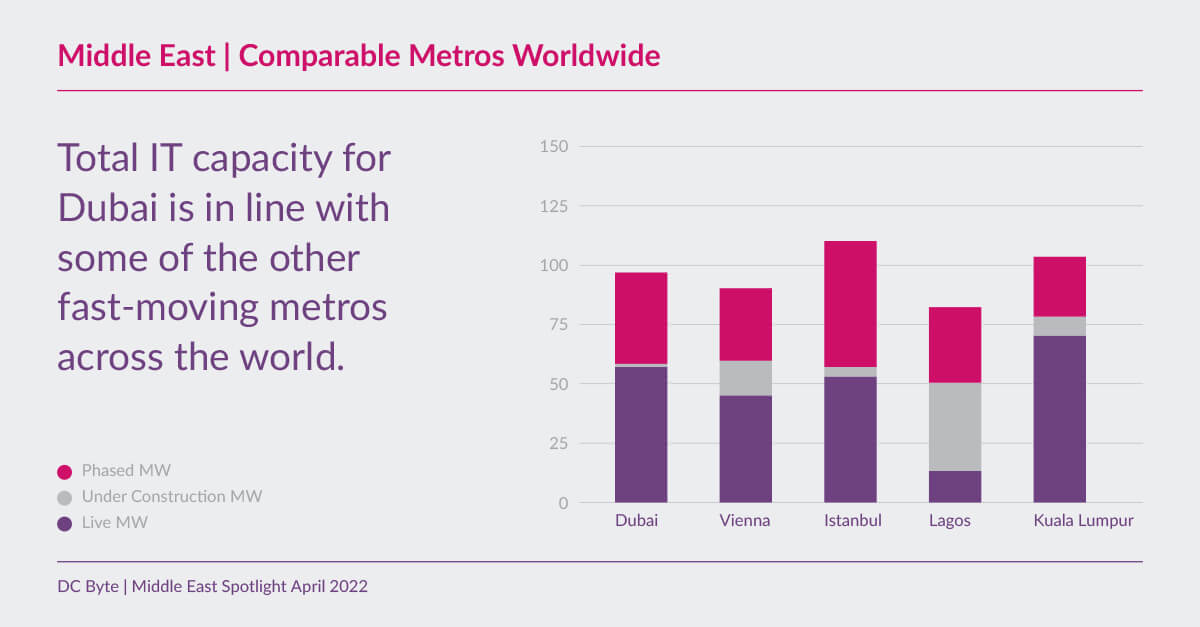

The Middle East is without doubt undergoing a significant growth trajectory and it is interesting to see how its largest metro market, Dubai, currently compares to some of the other fast-moving metros across the world, ranging from Vienna to Istanbul, Lagos and Kuala Lumpur.