Takoyaki Town

Osaka is entering the radar for many stakeholders in the data centre space – operators, investors, REITS, clouds and so on.

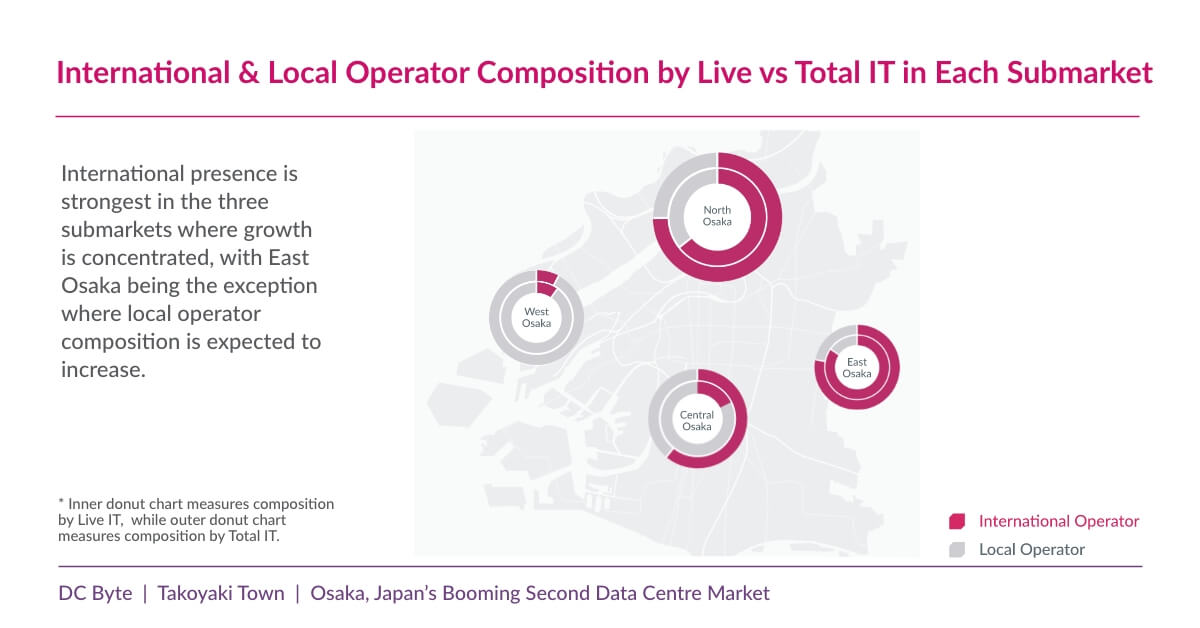

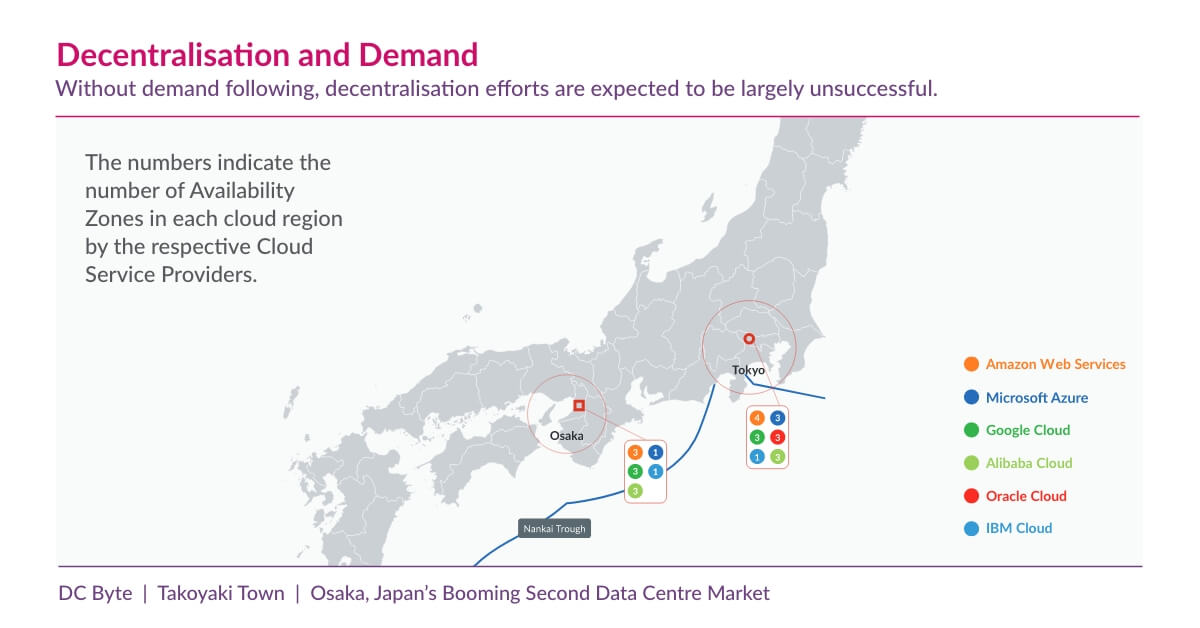

Supply growth is on the rise with strong international activity, and the secondary Japanese market having its own cloud region also hints at a long runway for cloud demand.

Ranking third in the country in terms of population and GDP, Japan’s secondary data centre market of Osaka is second only to Melbourne (Australia’s secondary market) and trumps Jakarta (Indonesia’s primary market) in terms of qualified IT (Live + U/C + Committed).

Companies and research institutions in the environmental, new energies, pharmaceutical, and manufacturing industries are concentrated in Osaka, a market big on manufacturing and commerce. Demand drivers of data centre space in this region is quite similar to Tokyo, although the capital has the advantage of serving as the headquarters of many local and international

businesses.

Supply saw a significant increase in 2021 owing to announcements and the beginning of construction of a few sizable facilities mainly in Central and North Osaka. This supply growth is accounted for namely by ESR Group, Colt DCS, Vantage Data Centers, MC Digital Realty, Digital Edge DC, and SKYY Development.