Established and Emerging Clusters

London is one of the most established data centre markets in Europe.

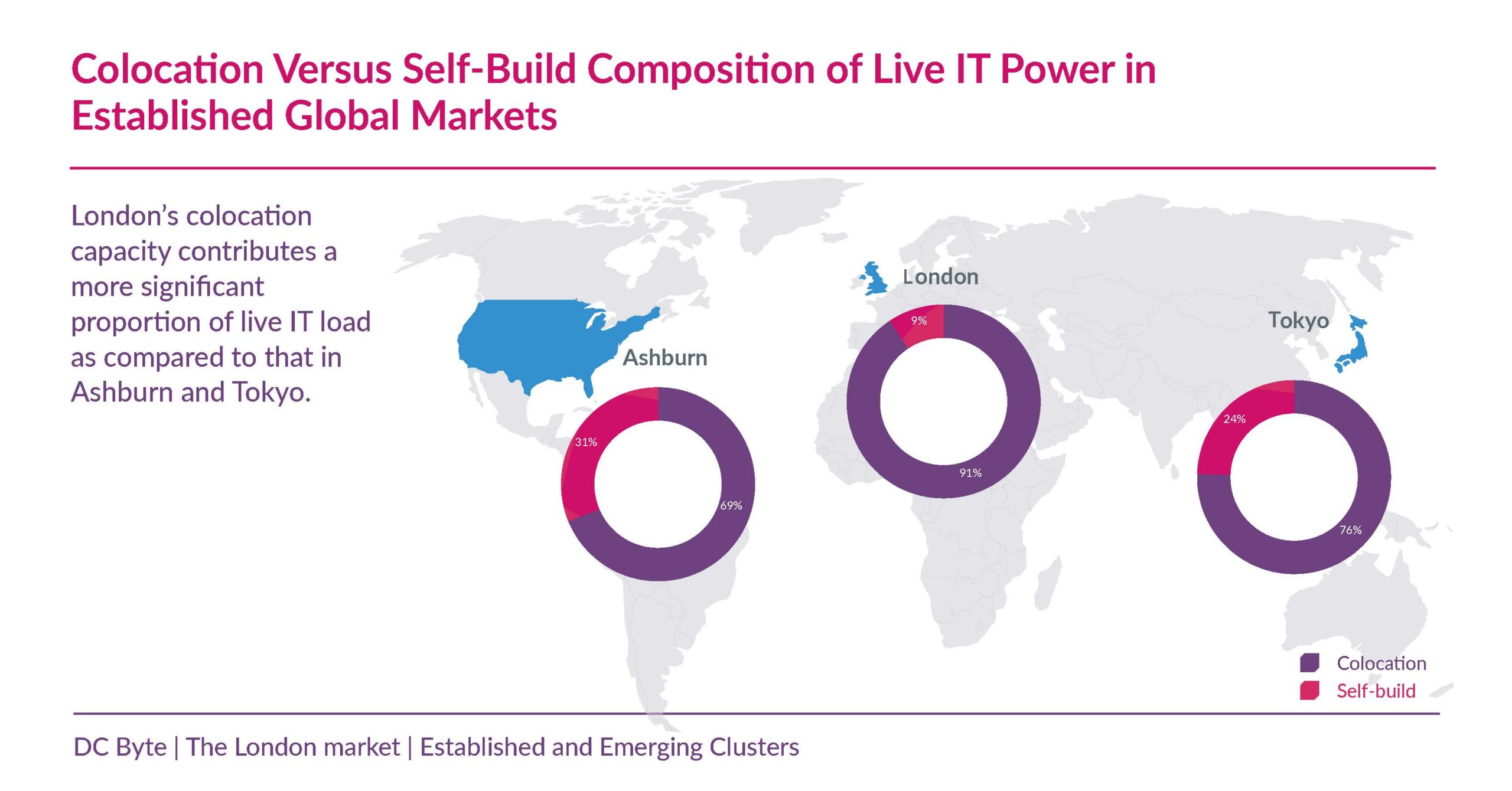

Unlike many European markets, London has not yet seen high numbers of selfbuilds among the hyperscalers. Instead, dedicated “wholesalers” such as VIRTUS Data Centres, NTT, NGD (acquired by US operator Vantage Data Centres) and Ark Data Centres have continued to secure multi-megawatt deals from public cloud providers.

The London data centre market is by far the largest in Europe and the second largest data centre market in the world, after the Loudon market in Northern Virginia. London’s data centre market grew from its dominant financial industry, who were the early adopters of data centres and fibre outside telecommunication switching houses. The banks’ decision to open facilities and take colocation in Slough led to it becoming London’s key development location. Since the proliferation of the public cloud, London has seen substantial development, with The London Docklands and Slough in West London becoming two of the most prominent submarkets in EMEA. In comparison, Slough and West London has 521.52MW live IT power compared to emerging markets such as Milan and Madrid which have 195.82MW and 161.85MW, respectively.

Ashburn, London and Tokyo can be considered the most significant markets in their respective regions. They provide a good indication to where a market can progress to when we see a sustained level of demand. Comparing the three locations offers a holistic view on how markets across EMEA, APAC and North America can develop.