The Nordics, which comprise of Denmark, Sweden, Finland, Norway and Iceland, have historically been considered as some of the smaller data centre markets. However, recently we have seen significant growth in this region.

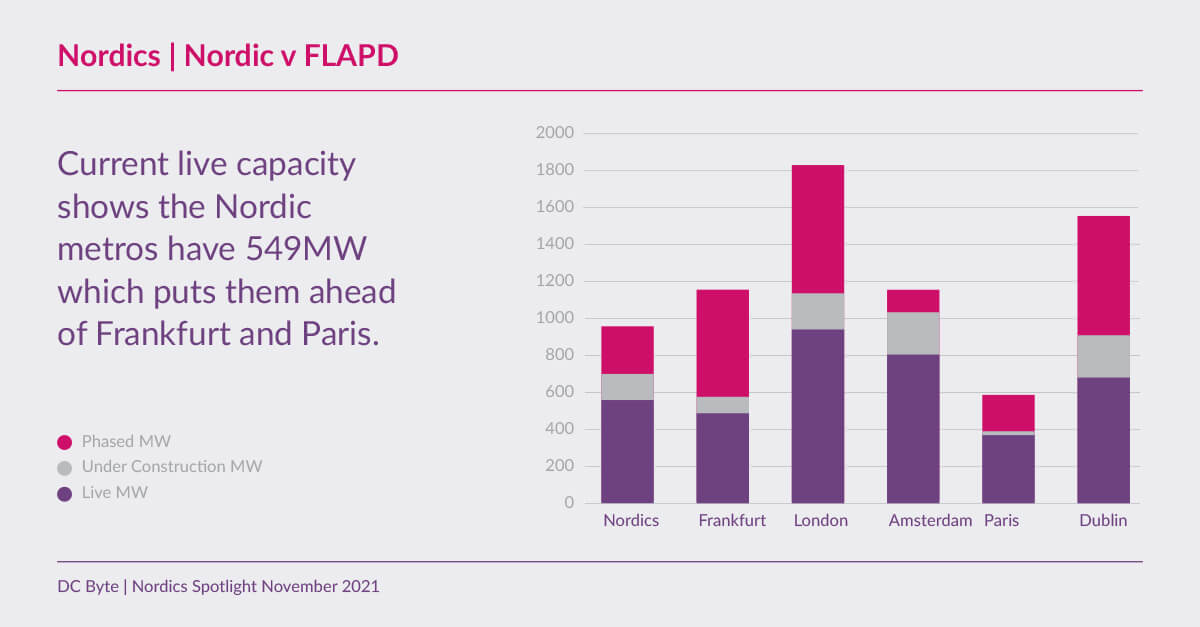

This is perhaps best illustrated when considering the ranking of the Nordic metros in comparison to both the FLAPDs (Frankfurt, London, Amsterdam, Paris & Dublin) and also the sixteen largest European metros excluding both the FLAPDs and the Nordics. For example, looking at live capacity, the Nordic metros have 549MW which puts them ahead of Frankfurt and Paris.

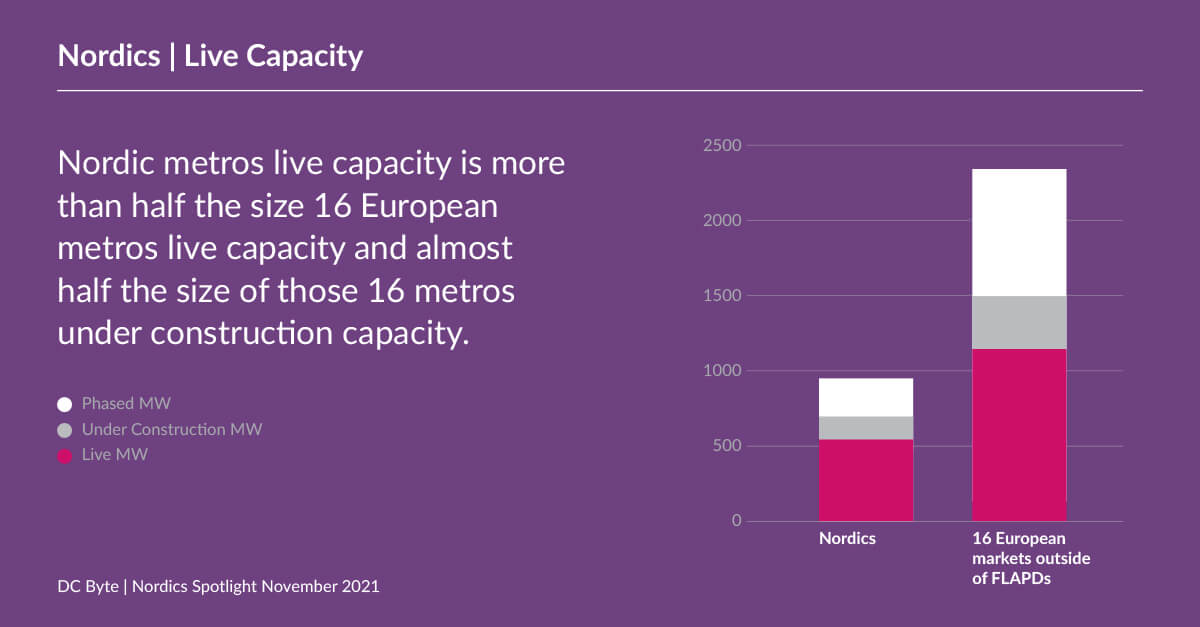

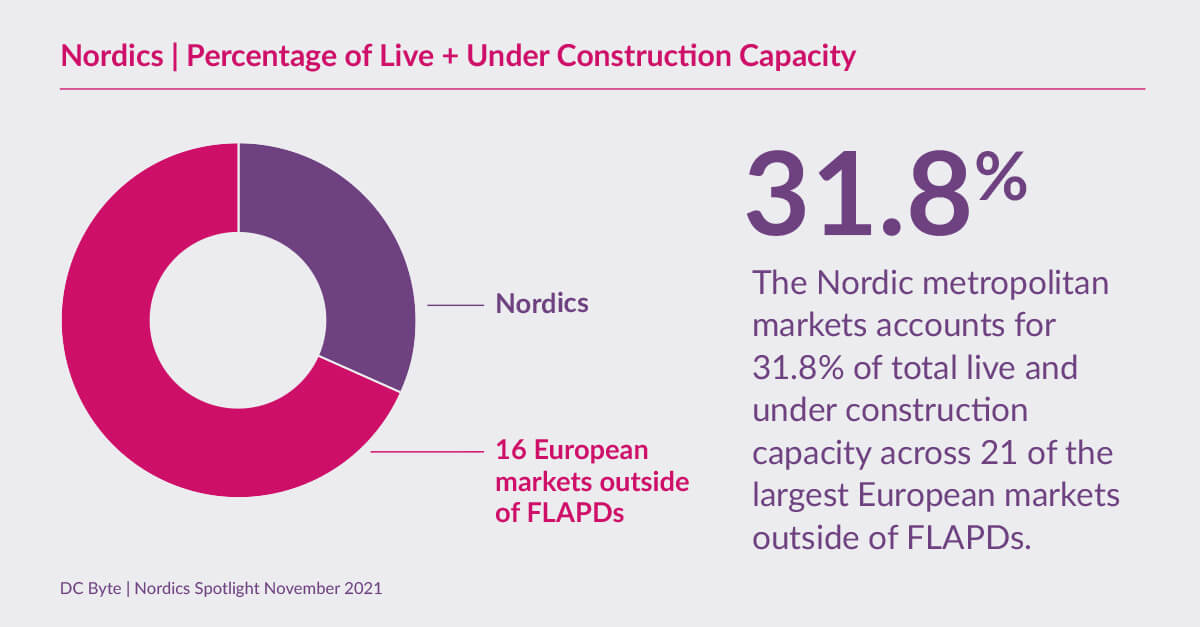

Further comparing the Nordics to the sixteen largest European metros we see them being almost half the size of those markets. The Nordics have seen significant growth from around 2017 when these markets started to have over 200MW aggregate supply increase annually. There is no single leader market within the five countries, since every year the highest share of new supply has emanated from a different market.

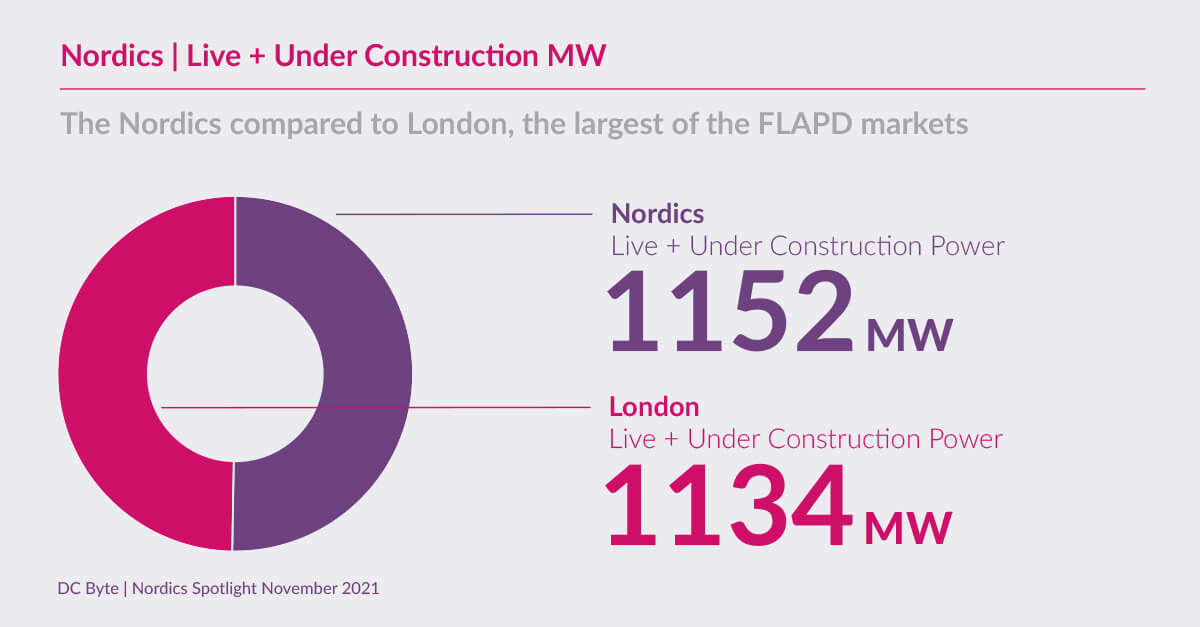

Live and under construction capacity in the Nordics has already overtaken London, the largest of the FLAPD markets, by an estimated 18MW. Whereas in the London market, data centres tend to be more evenly spread in terms of total capacity, in the Nordics the majority are either below 5MW facilities or large scale campuses above 25MW.

The significance of Nordic markets is notable, for example, Stockholm’s live capacity is equivalent to Madrid and Lisbon’s live capacity combined, while Iceland’s live capacity is of a similar size to Munich.

Much of the growth in the Nordics has been seen in Sweden and Denmark which became popular locations for enterprise hyperscale deployments. Across the twenty six largest European markets, live self-built public cloud deployments are mostly located within the FLAPDs; around 20% in Nordic metros and over 18% across the rest of Europe.