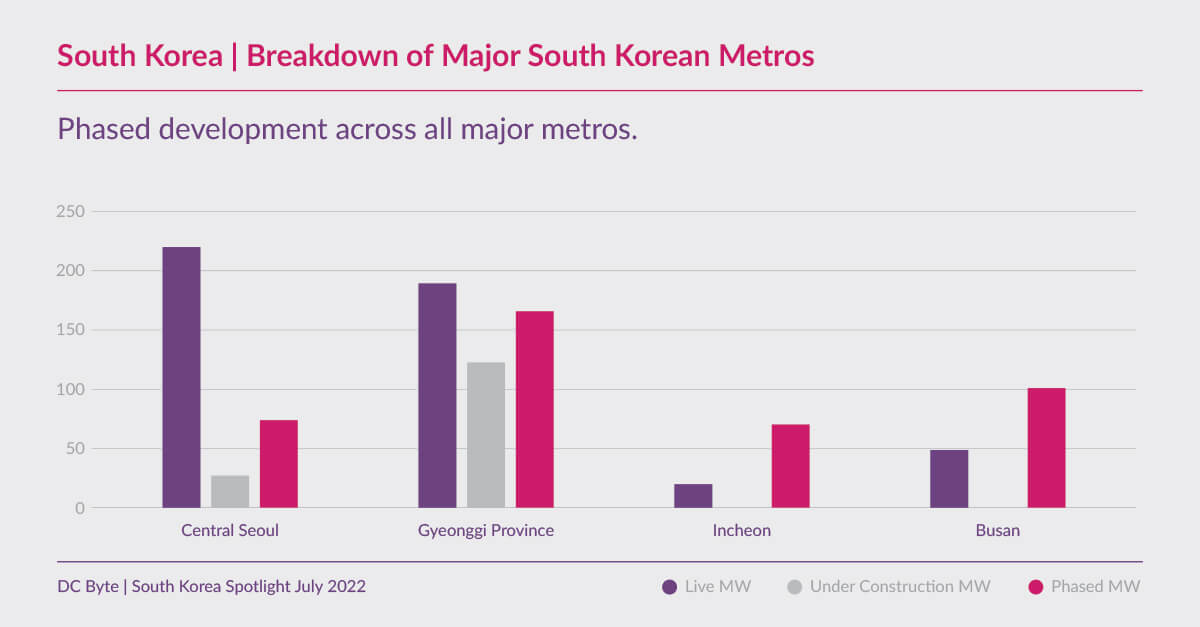

South Korea’s data centre industry is primarily concentrated in four key metros: Central Seoul, Gyeonggi, Incheon and Busan.

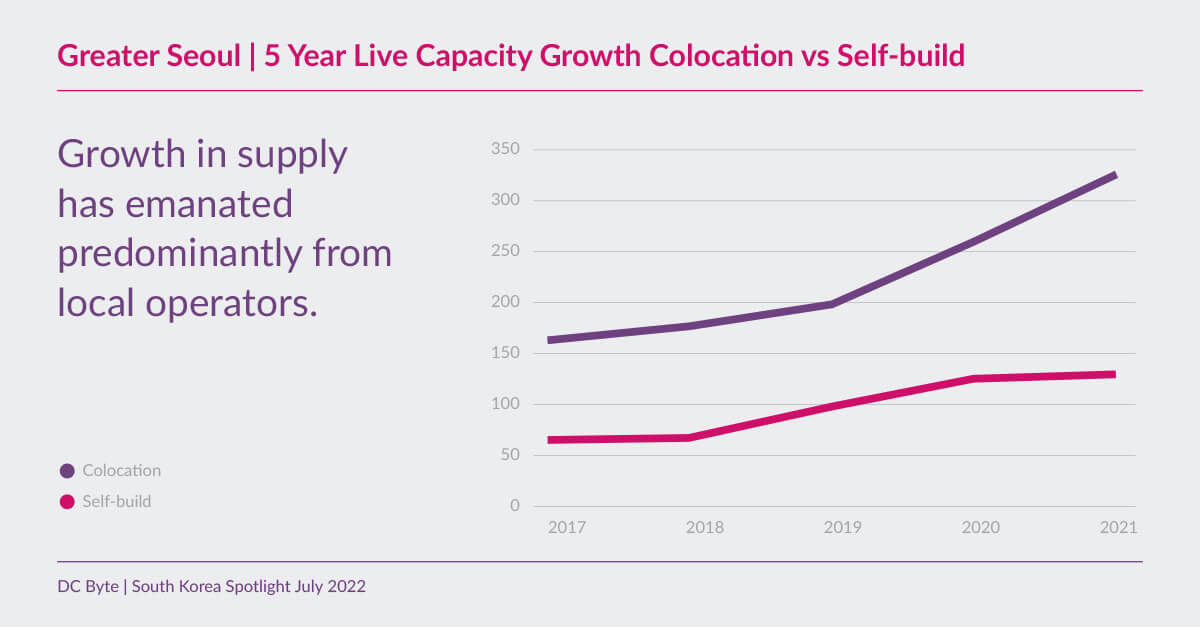

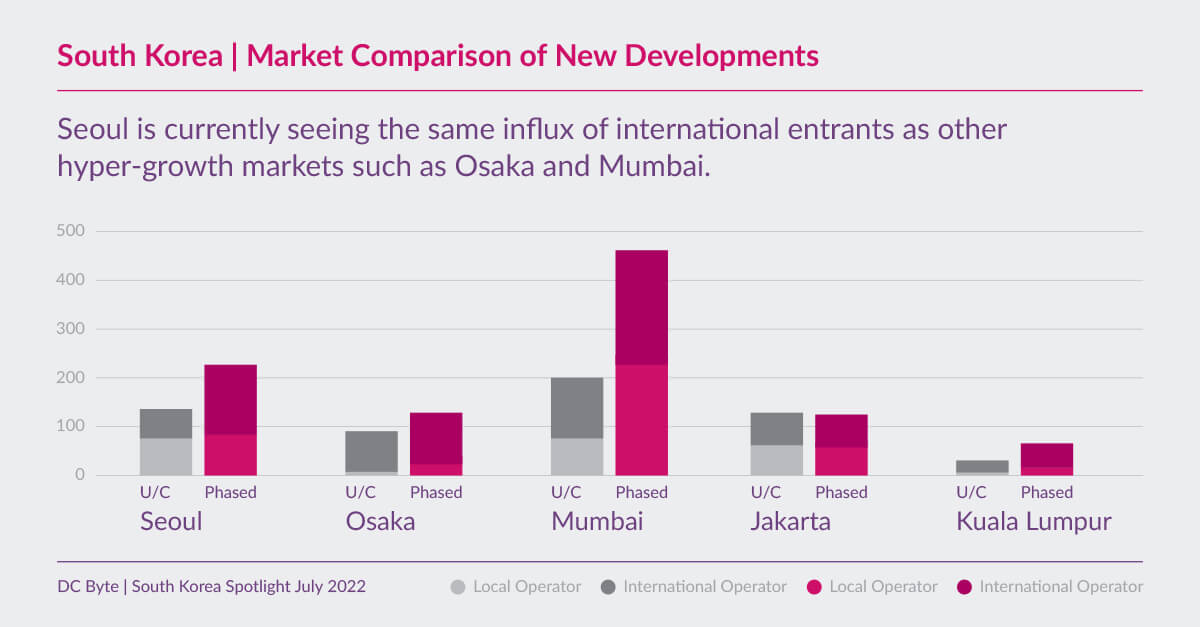

Live supply in Greater Seoul has almost doubled over the past four years, seeing a steady growth in both colocation and self-build capacity. This growth has predominantly emanated from local operators. Seoul is currently seeing the same influx of international entrants as other growth markets such as Osaka and Mumbai. Both of these markets have a strong pipeline, with a significant proportion of under construction and phased capacity.

New developments are shifting away from central Seoul with nearly three times as much under construction and phased capacity in Gyeonggi as there is in the capital, where we expect live supply to increase by 45% and 150% in Seoul and Gyeonggi respectively over the next few years. This is due to both push and pull factors such as land and power constraints within Seoul, as well as tax incentives for data centre developments in Gyeonggi Province. Meanwhile the majority of new developments from both local and international operators are going to cities such as Anyang, Yongin, and Goyang in particular.

Central Seoul

Central Seoul was first data centre hub in South Korea and is where the majority of legacy facilities are located. Growth in live capacity has been slow but steady, with the largest increase seen in 2021.

The market is predominantly colocation, with a gradual shift from retail to wholesale over the past decade to meet increased demand. This submarket mainly comprises the local telecommunications companies and smaller local retailers, with international players only entering the market in the last couple of years. However, central Seoul is also the metro facing the highest power constraints in the country which is pushing new developments into other areas.

Gyeonggi Province

IT capacity in Gyeonggi totals 456MW, of which nearly 60% is under construction or phased. The province has a greater composition of self-build by financial institutions, MSPs and local cloud providers in comparison to Seoul. This region has seen exponential growth in the past two years, growing by 269MW of total capacity (144% increase) since the start of 2020.

While facing similar power constraints to Seoul, municipal governments have been trying to attract data centre developments, hoping to spur infrastructural and economic development. Thus, growth is expected to continue due to the relative ease of securing land and power, while still maintaining proximity to Seoul.

Incheon

The market is small and consists primarily of self-build facilities although recently has started to see more interest.

Busan

Busan is the third largest submarket in South Korean with a total 150MW of IT capacity; of which 49MW is live. All three major local telcos have legacy data centres in this region and the only self-build facility belongs to a US cloud service operator.

Busan is where the majority of submarine cables land in South Korea, connecting the country to the rest of the world. However, its distance from the main market in Seoul has led to limited interest, although the local government is keen to develop the city into Korea’s international connectivity hub for data centres.

Summary

We expect Seoul and Gyeonggi to be the main hotbeds of activity, based on the current levels of interest seen from a number of international operators over the past few quarters. Local telcos have also been making plans for new data centres and expanding existing facilities to meet high demand. Outside of central Seoul, local governments are also keen to attract data centre developments to their cities through tax incentives and simplified application processes. The South Korean data centre market is poised for future growth which will be concentrated within and around the Seoul metropolitan area.