South Korea’s data centre industry has garnered significant interest as a hyper-growth market in recent years. As the base of one of the largest electronics manufacturers in APAC and a global innovation hub, South Korea leads in terms of internet speed and penetration, being the first in the world to launch 5G connectivity. The country also hosts a large media and gaming industry and boasts a highly digital society led by strong government efforts towards digital transformation in the public sector, with all these aspects driving cloud adoption and demand for data centre capacity.

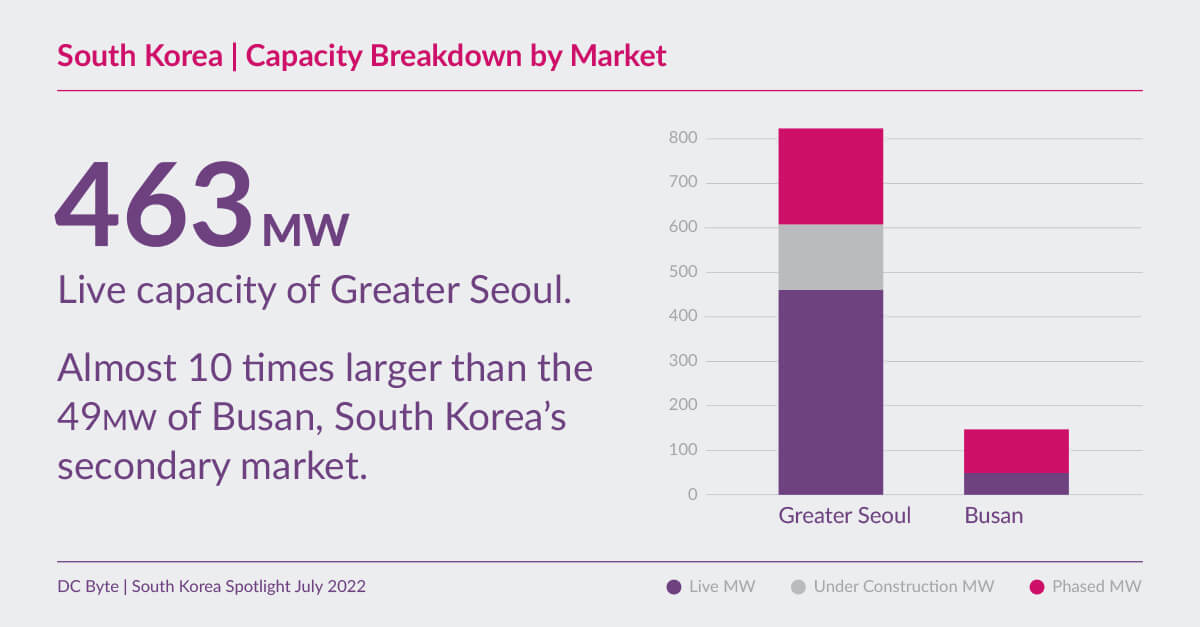

The largest concentration of data centres is located in Seoul, with Busan, to the south of the country, a secondary market. Significantly larger in size, Seoul has 463MW of live capacity. Despite having a larger population, Seoul has similar live capacity to the Hong Kong and Sydney markets which have 412MW and 468MW of live IT capacity respectively.

Of the total IT capacity in the South Korean market, three quarters is concentrated in the Greater Seoul region which includes central Seoul, Incheon, and the surrounding Gyeonggi province. Colocation facilities cluster inside and around central Seoul, whereas enterprise data centres such as those belonging to public and financial institutions and local cloud providers are located across the country where land is cheaper and there is a greater amount of power available.

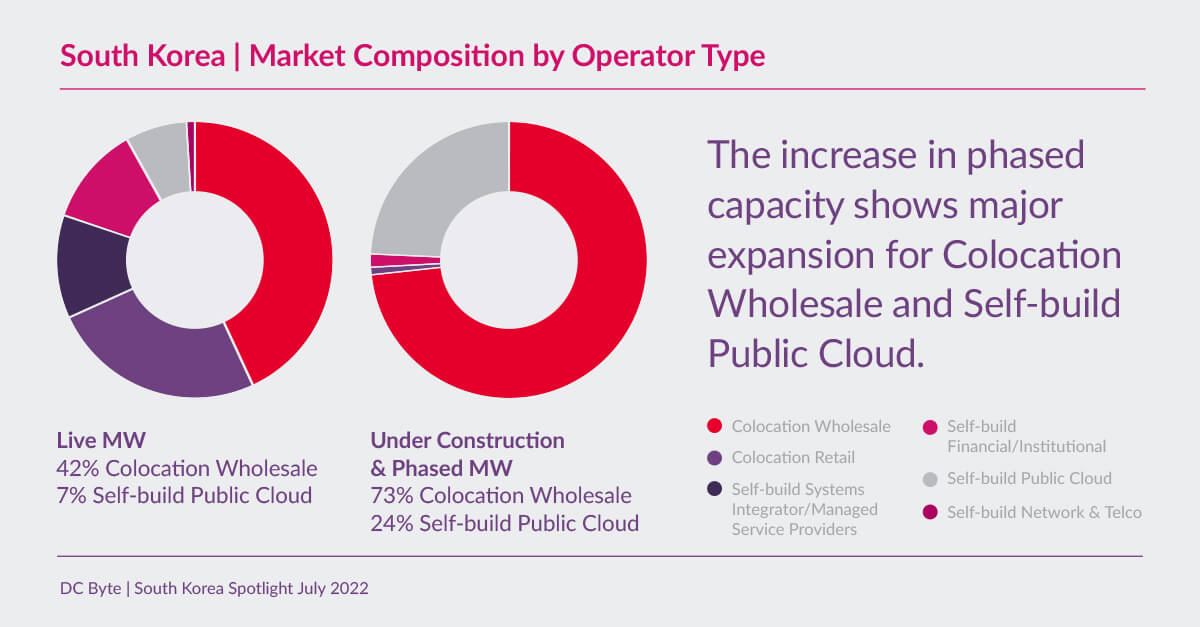

Wholesale colocation capacity in the market has increased slowly over the past ten years, with particularly high growth since 2020. This trend is expected to continue over the next 2-3 years to eventually account for 60% of all capacity. The growth in wholesale colocation is also an indicator of a maturing data centre sector – wholesale capacity only started to outpace retail at the end of 2020. In comparison, more established markets such as Singapore and Hong Kong achieved this milestone in 2015, whereas less developed markets such as Taiwan have yet to do so.

Amongst international cloud providers, Microsoft is the only one to have a self-build deployment. Its data centre is located to the south of the country in Busan, which is also the landing point for the majority of submarine cables linking South Korea to the rest of the world. In contrast, most of the cloud service providers have deployed solely through colocation facilities in Greater Seoul. This explains the increasing composition of wholesale colocation attempting to capture demand derived from future public cloud deployments accompanying the shift to a digital economy.

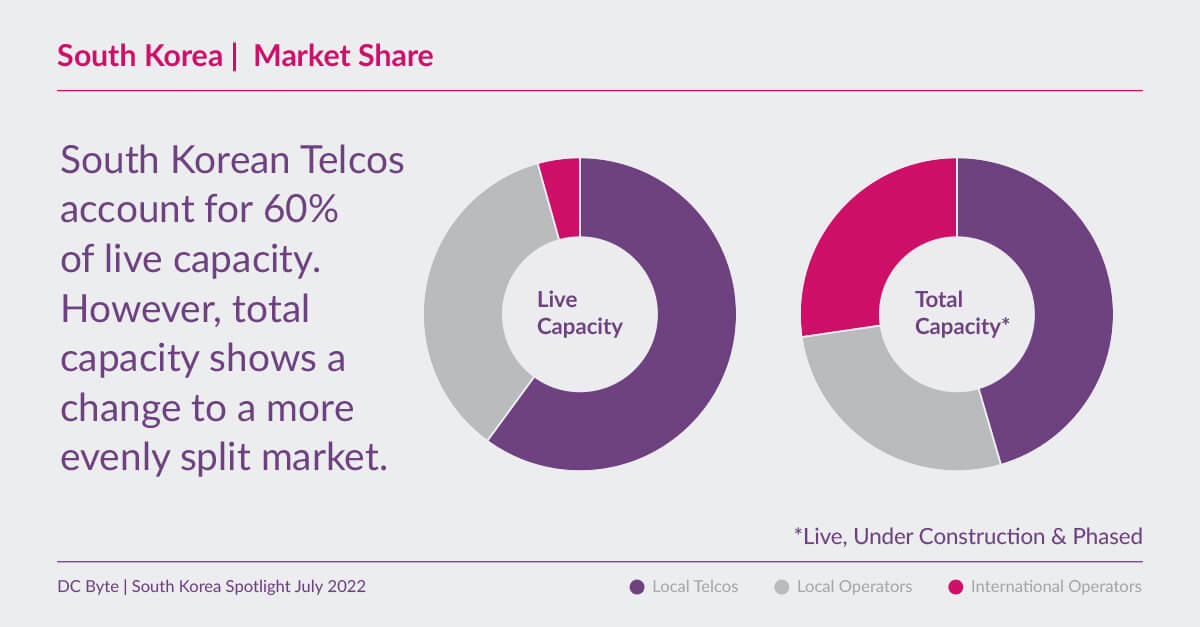

South Korea’s data centre market is one traditionally dominated by legacy telecommunication companies such as KT Corporation, SK Telecom, and LG U+.

Looking at live capacity in Greater Seoul, market share is divided in a 6:4 split between the South Korean telcos and other data centre operators, including both domestic and international players. The market is dominated by the telcos with 60% of market share based on live capacity. However, upon the inclusion of upcoming capacity that is currently under construction or phased, the market share held by international operators will experience a significant jump from 4% to 27%. The recent influx and expansion of international operators such as Equinix and Digital Realty will increase competition within the market.

Overall, South Korea stands at a similar stage of development to Singapore three years ago, observing a comparable 3-year CAGR of 22.3% in total capacity from 2019-2022 as Singapore experienced between 2016-2019 before the imposition of the moratorium (23.3%). Although the growth rate of Singapore’s data centre market has suffered, we expect that the South Korean market will continue seeing high growth of supply in the short-term as a “hot market” drawing major interest.