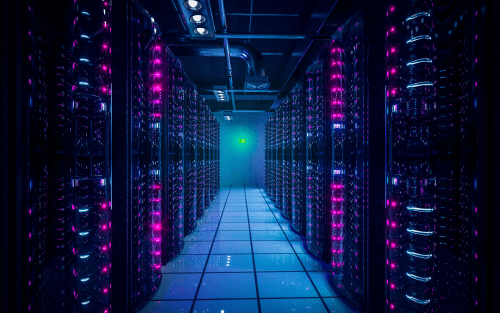

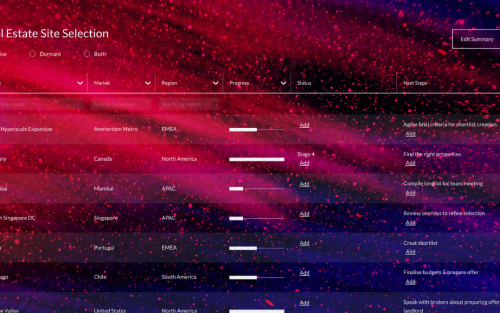

DC Byte, the leading data centre research and analytics platform, has today shared the latest insights from its Q2 2022 ‘Data Centre Report’, published in partnership with Knight Frank, the leading global property adviser.

The Q2 2022 report covers eleven data centre markets in EMEA – Warsaw, Vienna, Bucharest, Istanbul, Cairo, Manchester, Munich, Johannesburg, Casablanca, Nairobi & Zurich. These markets saw a record-breaking 2021 and M&A activity has continued at a pace as both enterprise and cloud markets continue to grow rapidly. However, a drop off in new supply across EMEA has been notable in 2022 as markets wait for IT capacity to come online.

Across the eleven locations studied this quarter, only Nairobi registered an increase in aggregate supply as many of the markets recorded significant growth at the end of 2021 or in the first quarter of 2022.

Zurich and Johannesburg continued to record above trend levels of take-up, as wholesale operators absorbed public cloud demand.

Overall, there was a 43% increase, which equates to just under 26MW, in take-up across the eleven markets as hyperscalers aggressively expanded their operations.

“Although development activity was somewhat low-key in Q2, we have still seen record levels of take up with hyperscalers continuing to expand into new markets. In turn, this has increased investment by international operators in markets that were traditionally dominated by local players” said Will King, Managing Director at DC Byte.

Ben Stirk, Co-Head of Data Centres at Knight Frank, said ““The sustained growth we’ve seen in the data centre market over the past two years continues to be resilient while we see the ever-increasing demand for vital IT infrastructure exceeding supply in both mature and now emerging data centre markets. As supply increases throughout 2022, we fully expect take-up of data centres to increase further in the highly competitive EMEA market.”

To view the latest Data Centre Report please click here

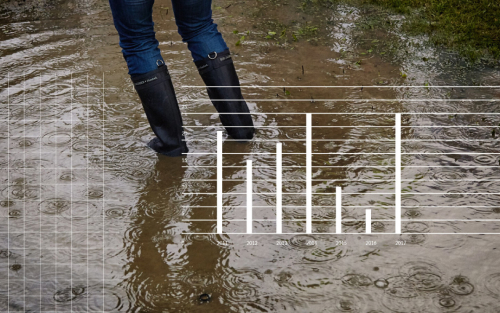

Nairobi, Kenya | Photograph by Michael Muli

“Although development activity was somewhat low-key in Q2, this can largely be attributed to the record levels seen over the preceding two years; meaning that a slowdown was inevitable to allow for supply to be absorbed”

Will King, Managing Director at DC Byte