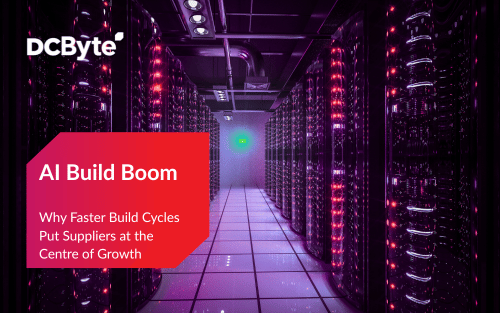

Amidst present market conversations on generative artificial intelligence (AI) and digital infrastructure, industry watcher interest in global data centre trends has only grown. With data centre developments at breakneck speed, keeping track of market movements has never been more crucial for key stakeholders such as investors and operators.

Billion-dollar investments by tech giants and multinational corporations frequently make headlines, but relying solely on these news clippings does not provide a comprehensive view of the data centre market. Typically, data centre developments, especially those involving hundreds of megawatts, are constructed in phases rather than all at once. This is why a nuanced perspective on data centre developments is crucial, and it’s the approach we’ve adopted.

A global perspective on data centre trends

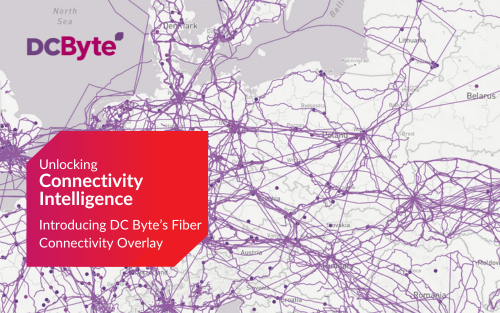

In our recent Global Data Centre Index, we highlighted several data centre trends to help clients and the wider industry gain a deeper understanding of the market dynamics in the Americas, Asia Pacific (APAC), and Europe, Middle East, and Africa (EMEA) regions. We did this by examining the different supply categories we track, offering a more detailed and accurate view of the data centre landscape.

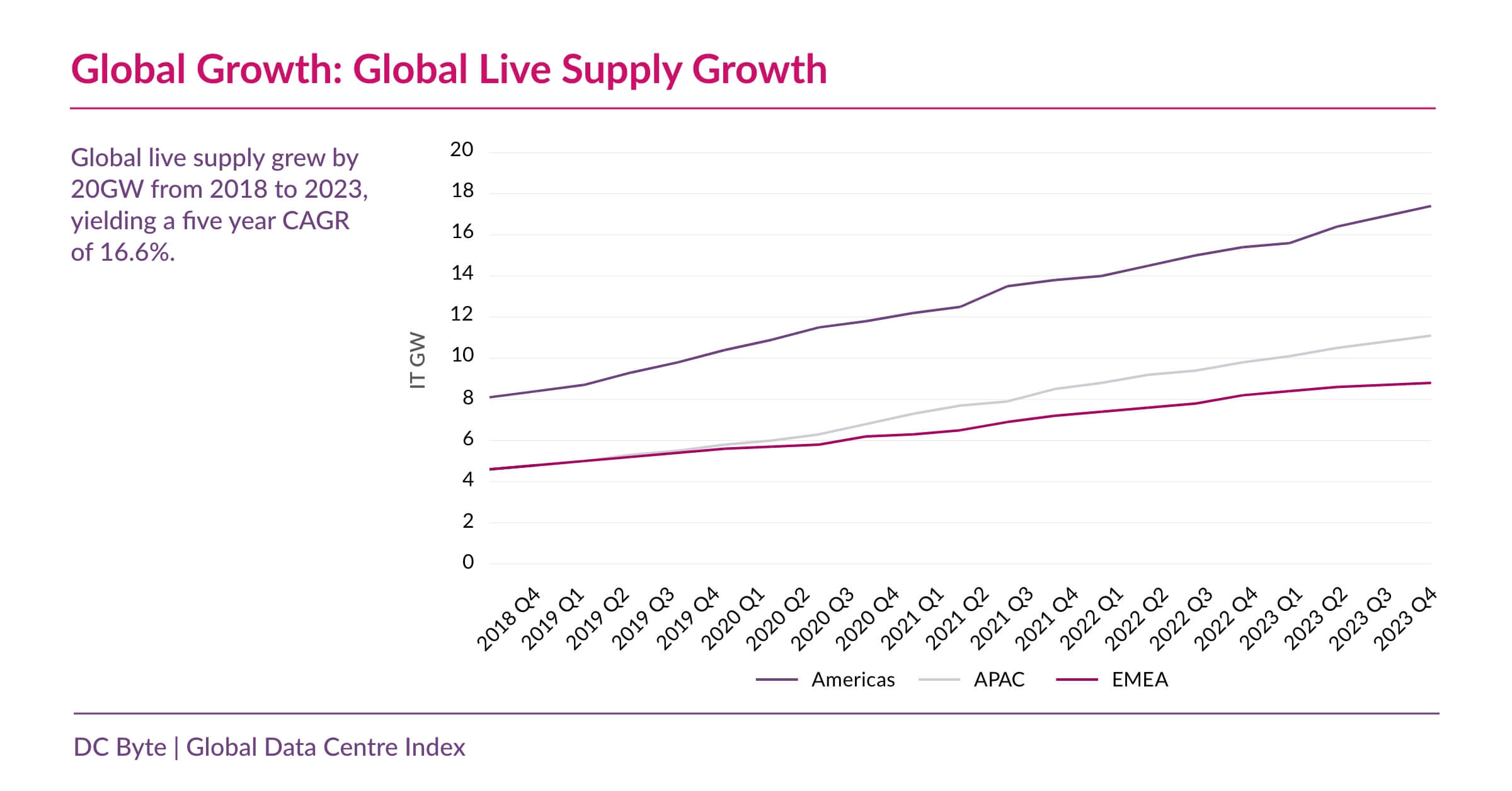

Live Supply refers to capacity in data centres that is fitted out, with all the necessary mechanical and electrical equipment to support that capacity installed in place. Across the three regions, Live Supply grew steadily with five-year CAGR rates from 2018 averaging 16.6%. As the home base of tech giants Amazon Web Services (AWS), Microsoft and Google, the Americas unsurprisingly maintained market leadership in terms of Live MW as well as all other supply categories throughout the five years. Meanwhile, Live Supply growth trends in the fast-growing APAC region had surpassed that of EMEA, with the latter’s development constrained by crucial elements to getting data centre developments off the ground.

What’s next? Data centres that are under construction or being planned

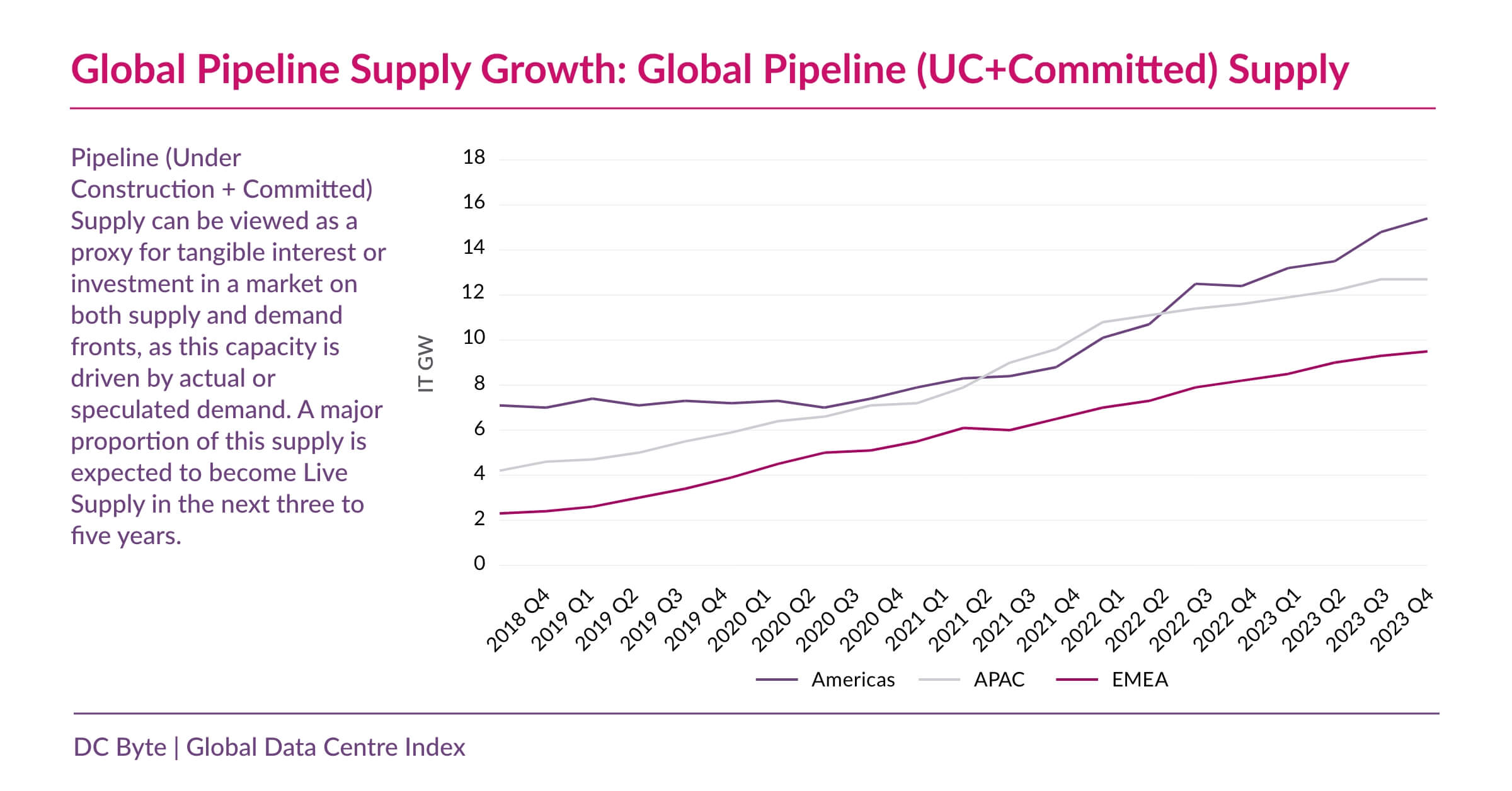

Live Supply offers just one piece of the puzzle; what about the rest of the planned developments? Pipeline Supply, encompassing both under construction and committed supply categories that DC Byte tracks, provides a good indication of the remaining buckets of developments that are being built out or have secured the necessary elements for development. Driven by planned AI deployments, which fundamentally depend on the development of supportive digital infrastructure, Pipeline Supply in the Americas grew to over 14GW. However, the growth rate of Pipeline Supply in the Americas was eclipsed by that of EMEA and APAC fuelled by the seemingly insatiable appetites for capacity expansions among hyperscalers regionally.

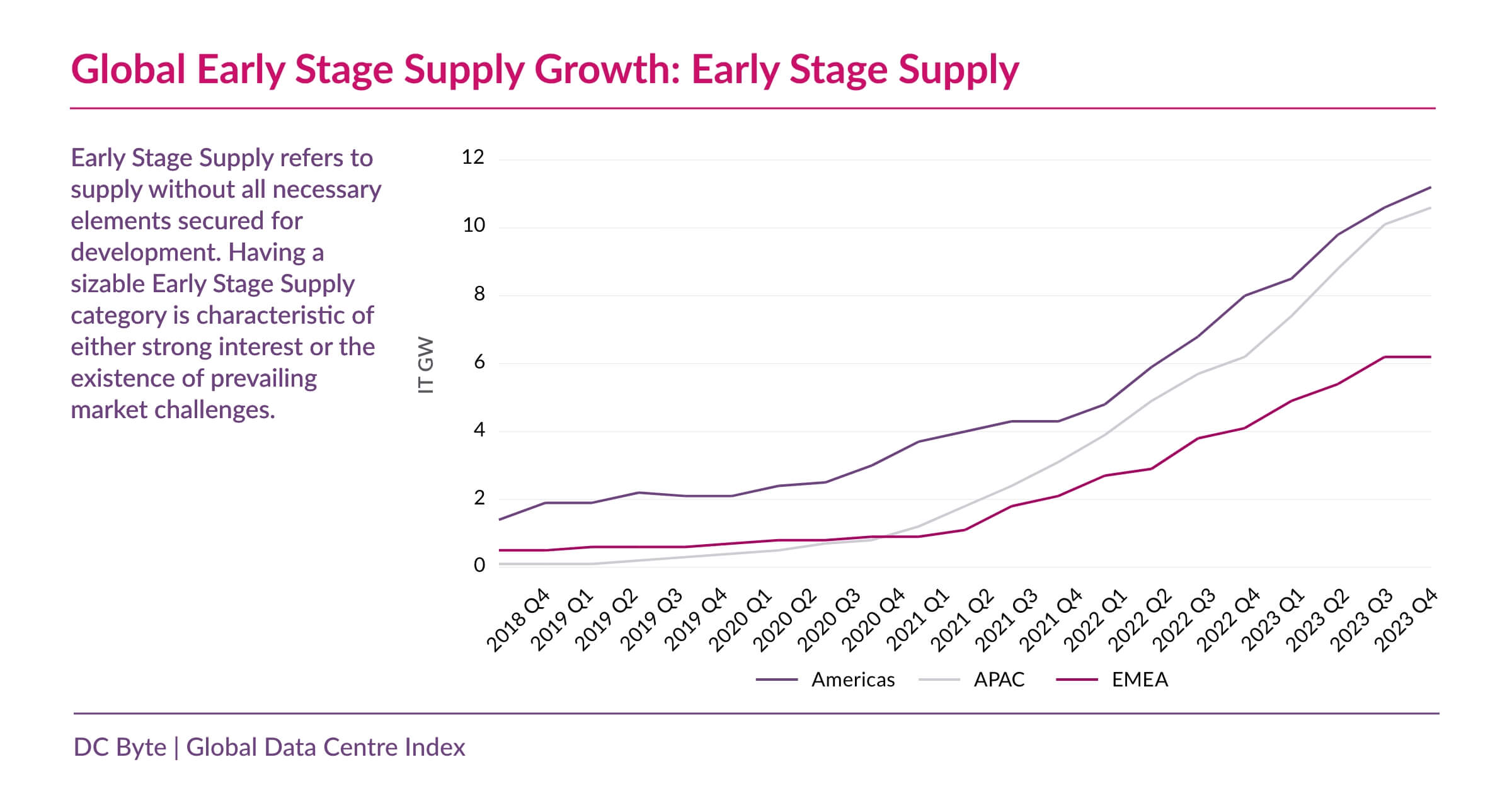

Multiple parties are now interested in getting a piece of the data centre pie, and our team frequently learns about data centre developments before they are publicly announced to the market, or when they’ve yet to secure all necessary elements for development. Recognising the potential of these developments however remains important when considering whether to enter a data centre market, since these developments could very well serve as competitive supply. To do that, we capture these plans under the Early Stage Supply category. Globally, early stage supply has grown exponentially, with CAGR rates exceeding 60%. A significant global trend is that these announced plans are increasingly emerging in new locations or upcoming secondary markets, away from the traditional primary hubs of data centre activity.

Overall, the positive growth observed in data centre trends across different supply categories are expected as established market leaders as well as new entrants announce multi-million investments in data centres. Curious about the actual numbers behind these trends we’ve shared? (We get it – we love the facts and figures too.) Stay informed by downloading a free copy of our Global Data Centre Index 2024 here.

Looking for more insights on data centre markets? Get in touch with us.