In the rapidly changing landscape of digital infrastructure, understanding the nuances of data centre markets is crucial for accurate research and strategic planning. Our Global Data Centre Index 2024 report sheds insights on developed, developing and interest markets across each region. In this blog post, we take a look at what defines these categories of markets and consider their key characteristics. We also explore the similarities among the drivers and challenge of these markets.

What Defines a Developed, Developing and Interest Data Centre Market?

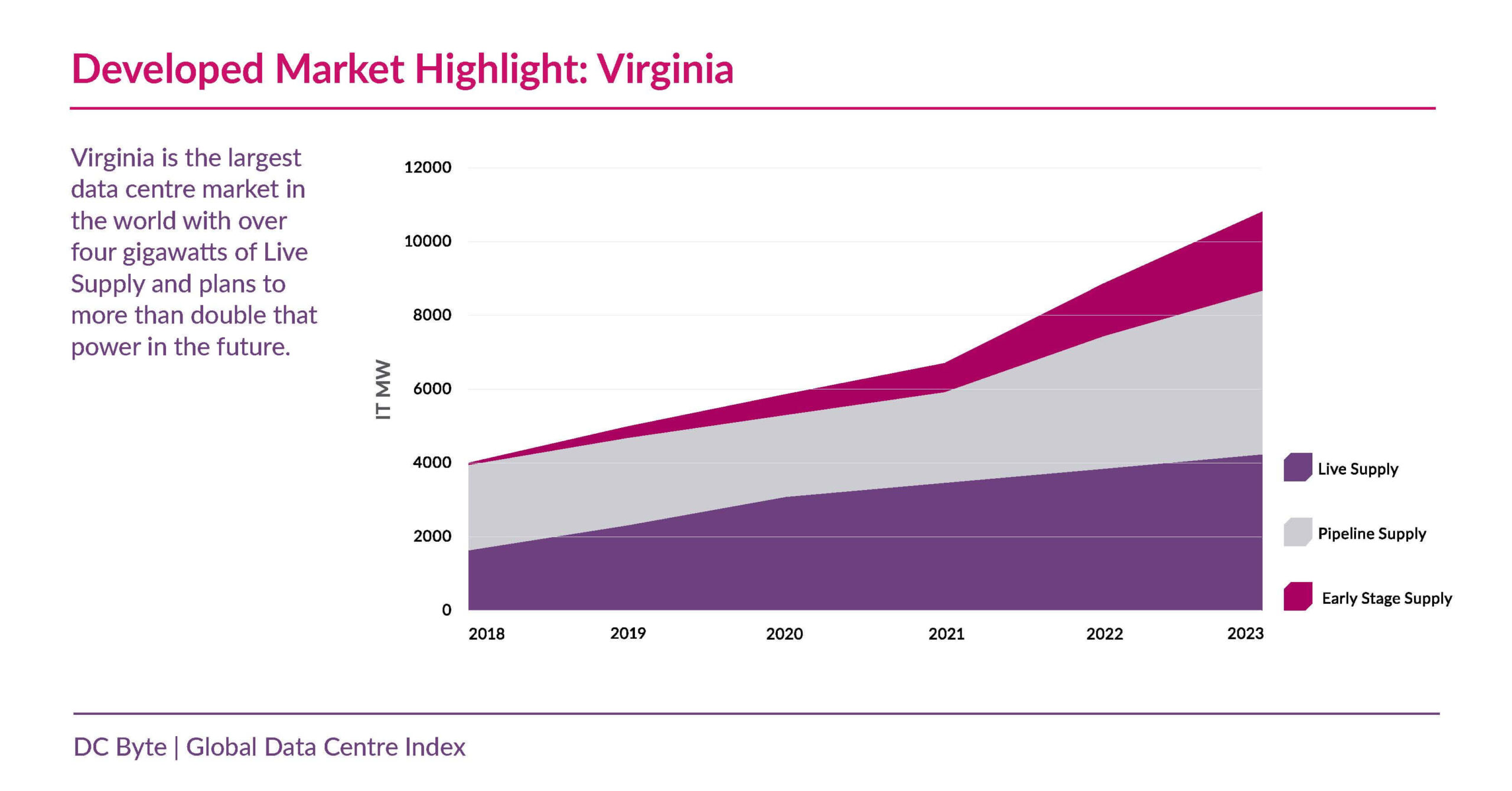

Developed data centre markets are the regional or primary established hubs. These markets are characterised by their robust infrastructure and significant Live Supply volumes. In our Global Data Center Index, we’ve highlighted key hubs such as Virginia (Americas), Tokyo (APAC), and London (EMEA) as leading examples of developed markets.

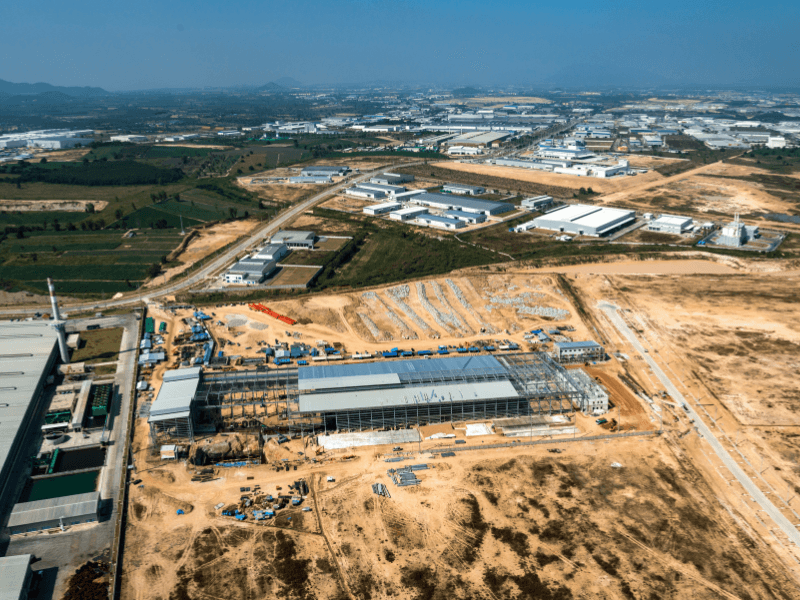

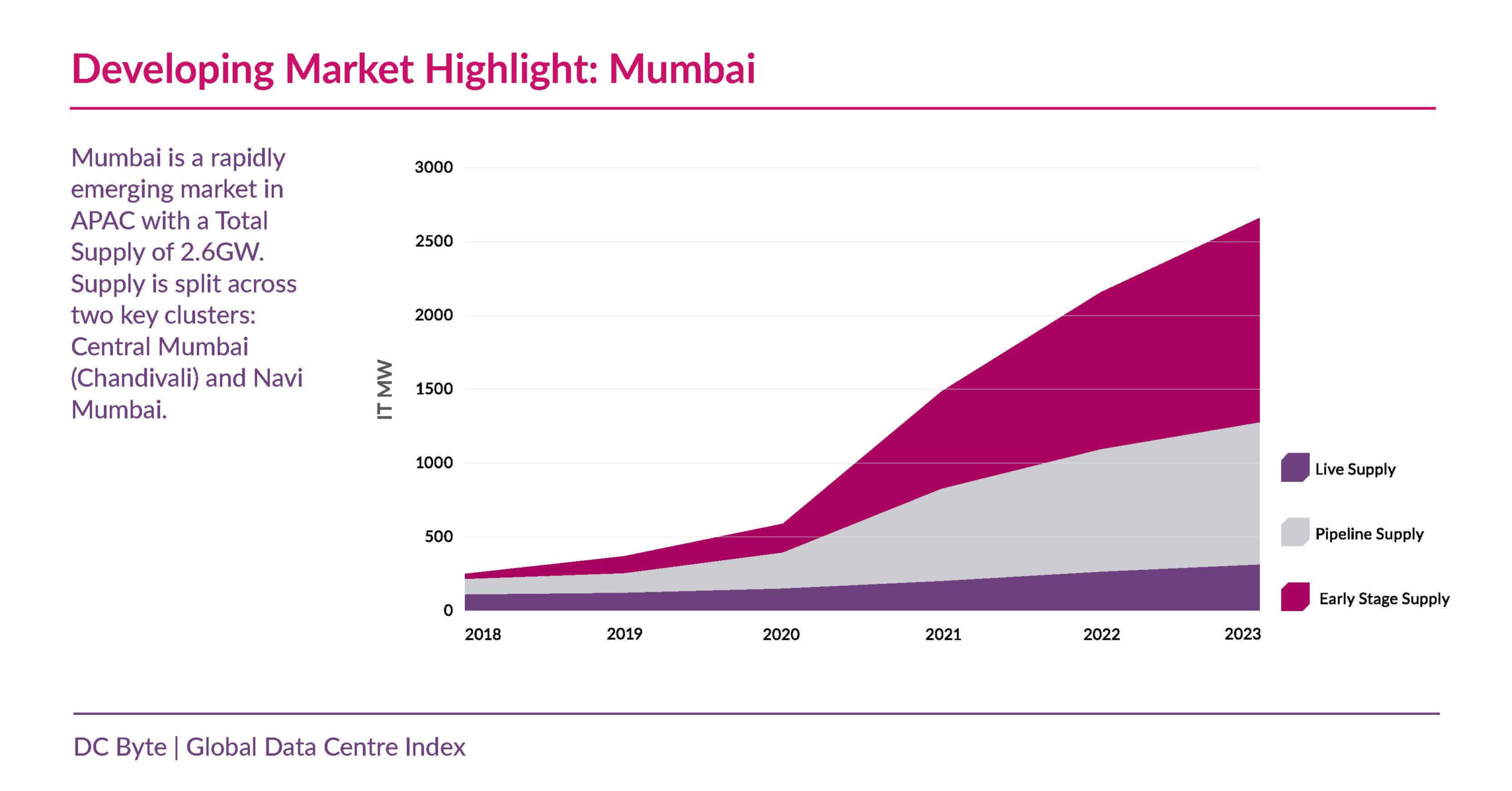

Developing markets are characterised by increasing digitalisation among the local population coupled with a rapidly growing economy, all of which drive demand for cloud services. These markets present attractive alternatives to traditional regional hubs for investments by operators and Cloud Service Providers (CSPs), with a commonality being the ongoing new self-build developments by the CSPs. This reflects in a significant and growing Pipeline Supply – encompassing both under construction and committed supply. Our Global Index report focused on the developing markets of New Albany (Americas), Mumbai (APAC), and Madrid (EMEA).

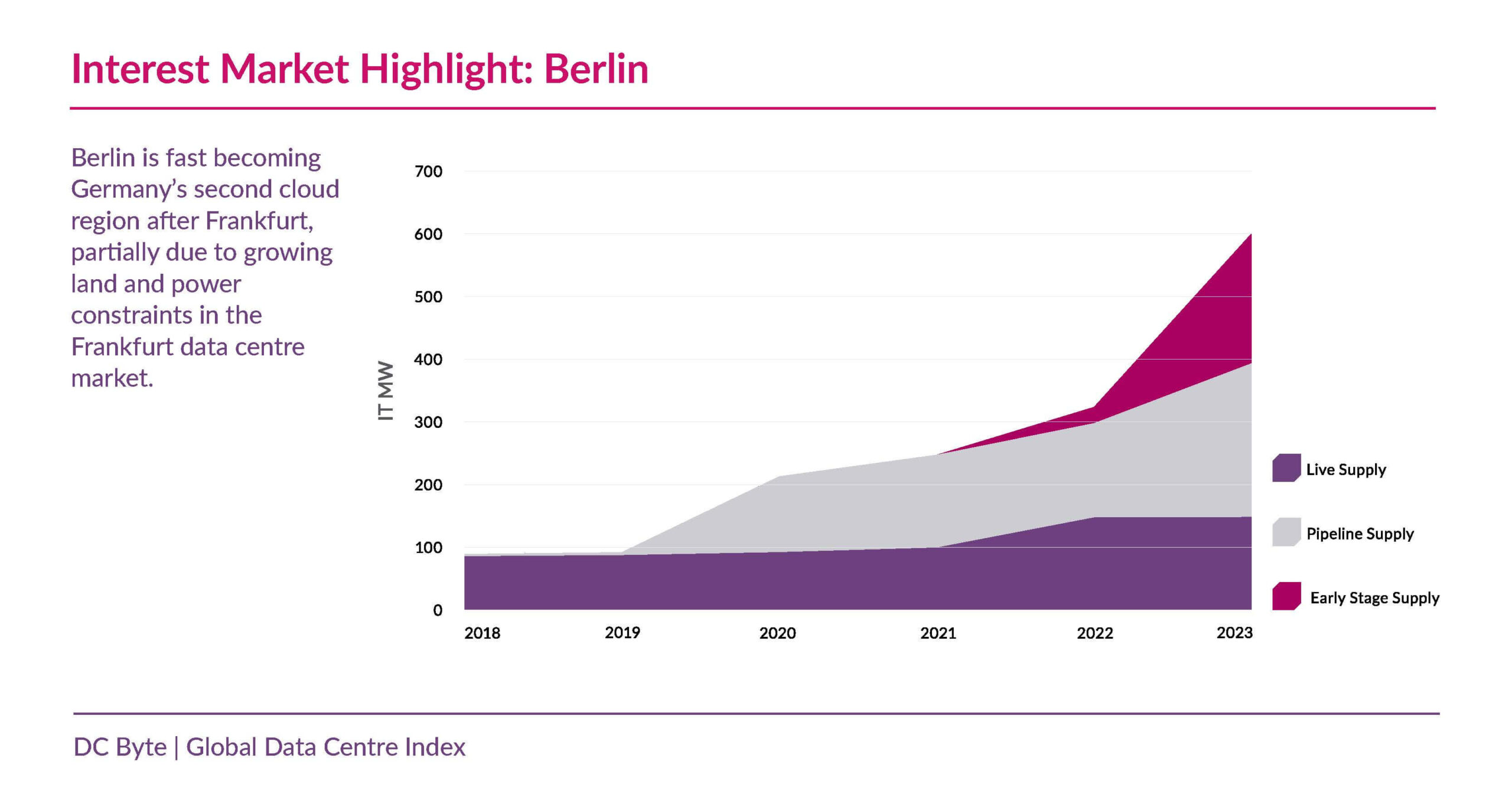

Interest markets, or emerging markets, are high potential hubs for future growth. These markets have seen a surge of investments, reflected in the significant increase in Total Supply. Our Global Index report features Salt Lake City (Americas), Johor (APAC), and Berlin (EMEA) as examples of these promising markets.

Characteristics of Each Market

Developed markets boast well-established infrastructure and are often the first to host CSPs like Microsoft, Amazon Web Services (AWS), and Google. In terms of market dynamics, these markets continue to experience steady growth in data centres, driven by consistent demand.

Developing markets are defined by increasing digitalisation among the local population, paralleled by a rapidly growing economy, driving demand for cloud services. These markets offer appealing alternatives to the traditional hubs for investments by operators and the CSPs. The ongoing self-build developments by the CSPs across the markets contribute to a substantial and growing Pipeline Supply – encompassing both under construction and committed supply.

Interest markets are characterised by their high potential for future growth. These markets have observed a sudden influx of investments, resulting in a significant increase in Total Supply. Notably, across the three Interest markets we’ve featured, Total Supply has grown by over 140% in just 36 months.

Market Drivers

Developed Markets

- Market Maturity: A mature data centre ecosystem with major colocation players and active international operators. Leading data centre REITs like Equinix and Digital Realty are prominent in these regions. CSPs are also present in the market, with multi-megawatt self-build facilities either operational or in development.

- Regulatory Environment: These regions have established regulatory frameworks and processes that influence and shape the growth of local data centre markets. Additionally, broader facilitatory policies such as digital transformation, data protection and environmental standards, play a significant role.

Developing Markets

- Resource Availability and Affordability: Developing markets typically have essential resources for data centre development readily available, with easier access to power compared to traditional hubs. Land prices are also generally more affordable, as observed in New Albany, Mumbai, and Madrid.

- Government Initiatives: Many developing countries are implementing policies to attract foreign investment in the data centre sector. In Mumbai for instance, the Government of Maharashtra has released IT policies with incentives to encourage new data centre developments.

Interest Markets

- First-mover advantage: Interest markets offer substantial growth opportunities due to their relatively low data centre penetration. Early investors have been able to tap into the early waves of demand and can easily expand their presence in these markets.

- Cost Advantages: These markets often offer lower operational costs compared to the developed and to some extent, developing markets.

Market Challenges

Developed Markets

- Power challenges: Extensive market growth often leads to constraints on the power grid. As a result, new developments and operators may face delays in power delivery or extended delivery timelines, as observed in Loudoun County, Virginia.

- Land constraints: As development intensifies, new data centre projects are increasingly being planned outside traditional clusters due to limited available land within these areas. For instance in East London, areas out of the city such as Chesham and High Wycombe have begun to attract interest.

Developing Markets

- Developing Infrastructure: As these markets mature, supporting infrastructure like power grids and connectivity are being developed concurrently to meet rising demand. In some cases, much of the available utility power is being contracted to planned projects, while other developments are expanding beyond the city centres to overcome emerging power challenges.

- Labour Shortages: White the shortage of industry labour is not unique to developing markets, they can be more pronounced due to much of the skilled manpower being concentrated in primary hubs. Over time, these developing markets might see more initiatives or collaborations with educational institutions to boost the talent pipeline.

Interest Markets

- Regulatory Guidelines: The nascency of some of these markets may signify the need for more guiding regulations. In most cases, governments would have had to step in with regulatory initiatives to support the growth of the local industry, as we’ve noted in the case of Johor.

- Dependency on Neighbouring Markets: Growth in some interest markets was catalysed by neighbouring market dynamics such as moratoriums or the saturation of primary data centre markets. With demand heavily hinged on the status quo in these neighbouring, these markets have sought to grow in independence in attracting data centre investments, often by regulating supply-side factors

Conclusion

In conclusion, understanding the dynamics of developed, developing, and interest data centre markets remains crucial for effective research and strategic planning, especially for investors looking to enter and invest in these regions. Each market presents unique opportunities and challenges that must be carefully evaluated. By leveraging insights from these markets, data centre stakeholders are better positioned to make informed decisions that drive optimal performance and long-term success.

For more in-depth insights on the developed, developing and interest markets we’ve featured, download our Global Data Centre Index 2024 here.